Last updated Mar. 12, 2023 by Peter Jakes

If you’re reading this, you’ve probably already realized that getting rich is not as easy as it used to be, but do not be despaired.

In this article, we’ll go over six essential steps you need to take to start your journey toward wealth.

1. Learn about relationships

The first step to becoming rich is learning more about relationships.

Relationships are essential in the world: Good connections will land you in good financial waters, while toxic relationships may likely land you into troubled waters.

Relationships are foundational to everything, from having a healthy life to starting a successful business and career. All successful people know this and leverage their relationships for their benefit.

2. Learn more about money management

Learn to manage your debt and get it under control once and for all so that it won’t hold you back from getting rich.

Know how to budget, save, and invest your money in a way that will help you achieve your long-term financial goals.

3. Make a plan to get wealthy and stick to it.

The first step toward getting wealthy is to figure out how you will do it. So your first action item should be to have a good plan.

This can be as simple as deciding what investments or businesses to pursue, but you must take the time and energy to sit down and think about your long-term objectives.

Once you’ve figured that out, test it out and continue to tweak it as you go. No plan is perfect from the start. Amend it as you go based on ongoing events, but make sure you don’t fall into the trap of making a plan today and throwing it out of the window the next week because of one challenge or the other.

Be patient, be hard working and be smart with your plan.

If your debt is limiting you from carrying out your plan, try first to start saving money but cutting some of your expenses and begin paying off your debt as quickly as you can.

Finally, once your finances are under control (or at least on track), stick with them! Don’t get discouraged if things don’t turn out exactly as planned.

Instead, learn from mistakes along the way and use them as motivation for future success.

4. Invest for the long run

- Invest for the long run.

- Diversify your investments.

- Get a financial advisor to help you plan for the long run. A financial advisor is not just for the rich it’s for everyone who wants to be successful with their money.

- Make sure you have a budget and follow it religiously!

5. Create an emergency fund

Make sure you have an emergency fund, so you can handle whatever comes your way without going bankrupt or miserable if something goes wrong, such as losing your job unexpectedly or needing major surgery.

6. Build your credit rating.

Step 1: If you don’t already have one, get a credit card!

If properly utilized, credit cards can help build up your score while also giving you access to cash in case of emergencies (like when payday isn’t until next week).

Step 2: Make sure every bill gets paid on time and in full each month. Remember: pay those bills! If there is any doubt about whether or not your payment was received by the due date, call customer service immediately before midnight on the day to get it sorted out before it rolls into your credit report.

Having great credit is especially important since having good credit history means being able to borrow money at lower interest rates which translates into saving money over time when compared to high-interest loans such as those offered by payday lenders.

Here is an extra bonus Point for reading this far

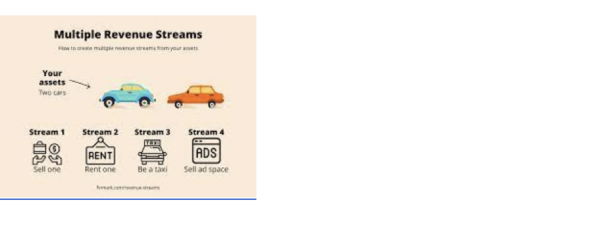

7. Add at least one new revenue stream every year.

A revenue stream is anything that generates money for you or your business. It can be a product or service.

But first things first: before you even think about adding another income to your plate, it’s essential to ensure that the ones already there are generating enough cash to keep you afloat—and, more importantly, happy.

If not, it may be worth looking at what can be done differently with those streams so they’re profitable enough for your needs.

Once this is done, it’s time to explore new ways to make money and earn extra income.

Frequently asked questions related to Becoming rich

How to become a rich man

If you want to become rich, one of the many things you can start doing today is to start reading.

Books are a source of knowledge. For example, you can learn how to invest, manage your money, etc.

I have read many books about finance and investing, and I know that books can help you increase your wealth.

-Do not waste time. Start reading financial books as soon as possible.

How to become wealthy in 5 years

It’s no secret that building wealth takes a lot of time, but it’s okay because the sooner you start practicing good financial habits, the more time those good habits have to grow.

It may seem too daunting to think about becoming wealthy in five years, but if you start now, you’ll be surprised at how quickly your wealth can grow.

The first step is to set goals for yourself. For example, my goal two years ago was to save $50k over the next five years and to become debt-free.

Now, 50k may mean nothing to someone else, while it is a lot for others. So, get your level mark and start saving every month.

Keep 30 % of every income you receive: Save 10% and invest 20% in micro stocks or real estate. Do this every month for 5 years and it will surprise you how wealthy you may have been.

How can I be rich without working?

There is really no way to be rich without working, except if you inherited great wealth.

However, you can make investments in stocks and real estate so much that you can live off the rental income or dividends without having to work.

You can become a landlord, invest in real estate and stocks, or start a business.

If you’re interested in getting rich without working, I recommend reading The Millionaire Real Estate Investor by Gary Keller.

What are the most straightforward steps to getting rich?

One thing we know for sure is that you should start saving money from day one. If you aren’t saving an emergency fund, you’re not saving for retirement. You’re just spending.

But that’s not all there is to it. The question is: what are the most manageable steps to get rich?

If your goal is to build wealth, here are a few things you can do right now:

1) Save money in the bank.

2) Do something that requires capital and learn how to become better at it than anyone else.

3) Become worth more than you spend.

4) Generate more income than expenses.

5) Constantly increase your net worth.

6) Pay yourself first.

7) Learn about compound interest and leverage.

How can I get rich in 3 months?

The first thing you need to do is figure out what you want to sell. You have to have something people will want to buy and they’ll feel good about spending money on.

Maybe you have a hobby you can market. Perhaps it’s knitting, or maybe it’s art. And you could probably sell something like that online using eBay.

To make a profit as quickly as possible, you want to take advantage of sites like Craigslist and eBay, where local buyers will be looking for your product.

You don’t want to use places like Amazon that attract international buyers because it’ll be much harder for them to find your item.

Once you’ve found the right places for your product, I’d recommend creating a plan to know how much money you’ll make and how much time it will take.

If your plan says that you want $1000 in 3 months, then at the end of those three months, if you don’t have $1000 in your pocket, it means that either your plan needs some adjusting or there’s something wrong with the execution of the project.

How can I get rich fast for free?

There are two ways you can get rich quickly. You can win the lottery, or you can make your own money.

The lottery is a bit of a long shot, but if you’re going to gamble, at least it’s one with the best odds—the chance of winning the lottery is 1 in 175,223,510.

The other option is the one that I would recommend, which is to make your own money.

It may sound simple, but it’s not easy. Making money requires great determination. If you want to get rich fast, you must want it and be willing to work for it.

What is the secret of getting rich?

Many people are looking for the secret to getting rich, and there are a lot of different answers to that question.

Some say it’s about being really good at making money.

Others say it’s about luck. But these approaches miss a big part of the picture: what is the secret to getting rich?

If you read many stories about people who are rich, it becomes pretty clear that most rich people become rich by doing something useful for others.

Of course, we can’t all be utility-providing geniuses like Albert Einstein or Steve Jobs, but we can still take some inspiration from them.

There’s nothing wrong with wanting to get rich—and if you want to get rich, you should do so. The trick is to think of your desire as a positive thing and find a way to provide a service or product people want.

Don’t dwell on what things will be like when you’re successful. Instead, think about how much better your life will be when you provide real value to the world.

Such a thinking pattern will help you find ways to contribute more than just money to your community and the world.

What is the 50-30-20 budget rule?

The 50-30-20 budget rule was developed by the financial planning website getrichslowly.org to help someone who wants to start saving and investing but doesn’t know where to begin.

The idea is that you should spend no more than 50% of your income on your necessities, 30% on your wants, and 20% on your savings and investments.

The 50/30/20 rule is also sometimes called the “golden ratio” or the “rule of 72” because it has a similar concept to one using 72 (72/50=1.44).

It says that if you divide your expenses into these three categories and make them equal, you will be able to live comfortably without going into debt or feeling like you can never save any money.

The 50/30/20 budget rule is just a guideline, however. Some variations of the budgeting rule go up to as high as 30 percent for savings and investments, but even that is considered low for many financial advisers.

Some people also use the 50 30 20 rule to allocate their purchases. They use it as a guide for what types of things they should spend their money on, rather than how much they spend.

Summary

There are several ways for you to start increasing your wealth and security today. Here are some of those methods:

Invest in a 401(k) or IRA. There are several options available when it comes to investing, but if you’re starting, consider using these two accounts as entry points into the world of personal finance. They allow you to set aside money for retirement without paying taxes until withdrawal.

Start building good credit by practicing responsible spending habits and paying all bills on time. Good credit scores can help lower the cost of borrowing money later, so they’re worth maintaining.

Improve your income by finding more work or making money through side hustles like freelance writing or selling crafts online. You’ll also want to consider ways to stretch each dollar further. Paying off high-interest debts is an obvious first step here.

The first step to getting rich is to stop dreaming about being rich but taking action to be rich.

The second step is to start saving money, and the third step is to invest it wisely.

![The Top Four Resources for Financial Literacy [2023]](https://paypant.com/wp-content/uploads/2024/06/The-Top-Four-Resources-for-Financial-Literacy-2023-768x512.jpg)