Last updated Jun. 13, 2023 by Favour Chinaza

10 Easy No-Spend Challenge Ideas to Save a Ton of Money

Saving money is difficult, but paying off debts is even more difficult. So, take charge of your financial life by participating in the No-Spend challenge.

You have two choices when it comes to paying off debt or saving for fun or not-so-fun but reassuring financial security.

You either raise your income or cut back on your expenditures.

There are drastic ways to cut back, such as downsizing your home or going to a one-car family.

Also, modest changes can pile up over time, such as the oft-repeated recommendation to make your own coffee or bring your own lunch. We all know all that plethora of ways to cut your living expenses.

When a big shift isn’t doable, and you need a bit more motivation (or cash flow) than a few bucks here and there, one item can quickly and easily put more money in your pocket: Consider a “no-spend” challenge.

Starting a No-Spend Challenge

A no-spend challenge is exactly what it sounds like. You commit to and push yourself to refrain from spending money on a specific type of item for a set period.

No-spend challenges are fantastic for beefing up your financial goals and achieving them faster than ever before. They’re also a lot of fun.

The fact that they are just fleeting adds to their allure. If you enjoy picking up your custom molatte coffee three times a week and imbibing it as you walk from your parking place to the office, you don’t have to give it up permanently.

The No Spend challenge forces you to commit to no expenses for a day, week, or month.

Decide Beforehand Where Your Not-spent Money Will Go.

Having a goal in mind before embarking on any no-spend challenge does two things.

First, a goal will provide you with a clear vision of what your money will accomplish. And by keeping your eye on the prize, you will strengthen your determination each time you begin to waver.

Second, your hard-earned cash will not “disappear.” If you just let it accumulate in your account, it will be spent quickly when you appear to have more money than usual.

Every time you don’t spend, put the money you saved into a budget line item. You’ll notice the money adds up, which will inspire you even more.

Good Read: 30 Budget Busters That Will Hinder Your Savings

What Exactly Is A No-Spend Challenge?

Before we go into how to do it, let’s review what this No-Spend challenge is all about.

This type of task is straightforward, but you can make it as difficult (or as pleasurable) as you choose.

A no-spend challenge is when you go without spending money for some time.

That is the most basic definition. It is your responsibility to put it into action. As I’ll show later, some people prefer to have a few allowances (such as gas and groceries).

Consider it like fasting but with your spending habits as opposed to your eating habits.

Why Take On Such A No-Spend Challenge

Taking a financial vacation offers various perks.

When you stop spending money, you become aware of all of your bad spending habits, just as when you fast from food and discover all your bad eating habits.

You’ll also have a better understanding of yourself and your finances. Obviously, refraining from spending money for an extended time can assist you in saving more.

You’ll have more money for debt repayment or saving for a vacation or a new car. Or you can even pay off your debts and travel the world.

This challenge will also force you to reconsider your spending habits.

- Are you a risk-taker?

- Do you have a habit of wasting money on unnecessary purchases?

Learning about these habits will help you change them once the challenge is over.

Benefits Of A No-Spending Challenge

A no-spend challenge is a great way to figure out which savings habits are most important and how to change them to reach your financial goals.

You could use the extra money you save during this challenge to pay off debt, start an emergency fund, or just save up for a trip you’ve always wanted to take.

● Highlight Your Spending Habits

A no-spend dare can help you figure out if you have bad spending habits or spend too much. By doing this, it can give you a reason to improve how you spend in the future.

● Save More Money

If you stop spending on things you don’t need for a while, you’ll save more money because you’re spending less.

So, you have more money in your account and can decide how to spend it and where to invest it profitably.

It will also help you in the long run, even after your task is over. You’re making yourself look at how much your way of life costs.

Once you can see how much you are spending, you can permanently move some of your income to savings.

● Boost Your Retirement Savings

Taking part in the no-spend challenge can help you save more money for retirement.

You might be able to put more money into a retirement fund, like an individual retirement account (IRA), with the money you haven’t spent yet.

Or, as you change your budget, you can put more money into an employer-sponsored plan like a 401(k) each month.

● Improve Your Budget

By not spending money on things you don’t need, you can see how you’ve spent money in the past.

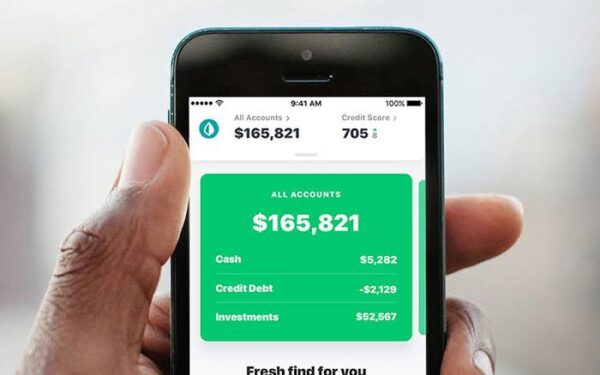

Budgeting well with the best budgeting apps can let you see if there are ways to keep spending less on certain areas and reorganize your budget to meet your needs better.

● Pay Down Existing Debts

Participating in a no-spend challenge can help you pay bills because the money you didn’t spend could go toward an extra credit card or personal loan payment.

Common Types of No-Spend Challenges

The 24-hour No-Spend Challenge

This is a great place to start. Even spending a few days without money will reveal a lot about your habits.

The 24-hour rule is a financial philosophy rather than a challenge. It requires you to wait one full day before purchasing something non-essential.

Clothes, literature, makeup, hobby equipment, gadgets, odd Amazon shopping – you name it.

The One-week No Spend Challenge

The one-week rule is similar to the 24-hour rule, except that you wait seven days before purchasing something instead of only one day.

We recommend following the one-week rule for purchasing large-ticket things such as a new phone, an inflatable kayak, an LV Bag, a Botegga, or any other pricey item on your wishlist.

You can establish ground rules for when you will wait 24 hours and when you will wait seven days.

For example, if you desire something under $200, you wait 24 hours to ensure you still want it. You have to wait a week if it is more than $200.

No-Spend Day

Now we’re getting into the actual no-spend challenges, in which you try not to spend any money for a specified time.

There will be no Starbucks. There will be no Amazon purchases. There will be no gas station chips.

You and a day filled with items you already have at home. A no-spend day is intended to help you become more aware of your behaviors.

You won’t become wealthy overnight, but the savings can quickly add up if you do one monthly or once weekly.

No-spend Weekend

When you’ve conquered the no-spend day challenge, try a no-spend weekend.

This is where you can spend the entire Friday, Saturday, and Sunday without spending a dime. A fun weekend challenge is beneficial because it forces you to calm down and allow your inner child to run wild.

No-Spend weekend reminds you that having fun doesn’t have to cost money. There’s free entertainment all around you, and even if you can’t miss a date night, there are lots of free date night ideas to try.

No-spend Week

Try going a week without spending the extra money to discover more about your daily habits and what you like buying the most.

A no-spend week is exactly what it sounds like you commit to not spending any money for the entire seven days. Exceptions can be made for debts and other essentials.

You can also pay those in advance and save the credit and debit cards for later. It’s your call! A week-long challenge means it will almost certainly overlap with work.

We recommend doing some meal prep ahead of time so that you have ready-to-eat lunches and meals each day.

30-day No-Spend Challenge

It is said that it takes 28 days to form a habit, so a no-spend month could be precisely what you need to make some long-term improvements.

But let’s be clear: a no-spend month is not for the faint of heart. It takes a lot of attention and focus, but staying with it may be quite rewarding.

Many people have completed the 30-day no-spend challenge and documented their full online experience. You can track them down and learn from their experience.

This will necessitate the most concentration and planning. If you do it for this long, you’ll wind up saving even more money.

This might be a strategy for implementing long-term changes in your financial behavior.

90-day No-Spend Challenge

A 90-day no-spend challenge is beneficial because you commit to going one-fourth of the year without purchasing any “wants.”

That is a significant lifestyle adjustment! You can’t simply put off a purchase for a month and then resume where you left off.

The no-spend challenge for 90 days does not have to be all or nothing. If you like, you can remove everything. You can also modify it somewhat to match your needs.

No-Spend Year

One of the more ambitious approaches to this challenge is a no-spend year. However, if done correctly, there can be numerous advantages.

No-spend years are for the real OGs. And they are certain to put the most money in your pocket.

If you undertake a no-spend year, try eliminating one type of spending – such as clothing, books, Amazon delivery, electronics, dining out, etc. Rather than eradicating all discretionary spending.

No-Spend Days vs. No-Spend Months

How long you take to complete your no-spend challenge is totally up to you. You can begin small and gradually progress to a greater time frame or dive right into a month-long challenge.

Discuss it with your spouse/partner and the duration of your challenge.

And if spending on entertainment like dates will be an issue, go for these fantastic stay-at-home date ideas that won’t burn a hole in your pocket or scatter your no-spend challenge.

Here are the best and easy No-Spend Challenge Ideas to save you a ton of money

10 Easy No-Spend Challenge Ideas To Save You A Ton of Money

1. Identify Your Goals and Rules

Your understanding of the goals and guidelines for no-spend challenges determines how well you perform in every endeavor.

That is why you must determine why you are participating in a No-Spend challenge and how you intend to reach your goal.

And to do so, you must first note every expense you incur in a month or week and then categorize them as essential or needless.

Make sure you know what you consider to be necessities because they can sometimes be frivolous expenditures.

After that, you can start allocating your funds. A No-Spending challenge does not imply that you will not spend money; rather, it is a challenge to refrain from spending money on things you can do without.

So spend your money exclusively on the necessities and avoid the frivolous ones.

When you’re through, put the rest of your money somewhere you can’t get a hold of it to keep you from succumbing to temptation.

2. Use a Prepaid Card

Although a prepaid card is an option for those who do not have a bank account, it is a useful tool that can help you go through a No-Spend challenge period.

A prepaid card is one that only allows you to spend the money that you load into it.

So, if you’re addicted to the credit benefits provided by credit cards, acquiring a prepaid card will reduce your need to use credit.

This is because you can only spend the amount on the card.

In other words, having a prepaid card keeps you from incurring debt and gives you a clear picture of your spending restrictions.

To begin utilizing a prepaid card for the No-expenditures challenge, you must first track your expenditures for a week or month.

Then, only load your prepaid card with the amount that should be sufficient for the No-Spending time.

This No-Spending challenge idea keeps you on track with your objective and provides you with a real-time progress report.

3. Shop with a List

Pushing your trolley around a store with a list in hand may seem archaic.

However, if you’re serious about attaining a good result at the end of your No-Spending challenge, you should definitely examine this suggestion.

Going to a store without a specific purpose will result in impulse purchases.

As a result, to avoid this, write a list of important items to purchase and bring the list with you to the store.

When constructing your shopping list, you should carefully evaluate each item. Just because you believe you require a product does not imply that you do. Be prudent!

Make a note of the items you are prone to purchasing on impulse.

This will help you train your mind to ignore them when you see them in a store.

To practice this concept, go shopping with the precise money needed to purchase the goods on your list and check out other ways to save on grocery shopping that can inspire your no-spend challenge.

4. Identify your Spending Triggers

Does it ever amaze you how you keep making unwarranted expenses even after promising to give your best efforts to save? Well, don’t think about it too much! This happens a lot to many of us.

But just because it’s common doesn’t mean it should be accepted because it can stand in the way of your No-Spending challenge.

So to prevent this, there’s an idea that helps you. It involves you identifying your spending triggers. This challenge can help you have a hold on the bad spending habits to avoid if you want to build wealth.

If you can get a hold of what spurs you to spend, you’ll gain the ability to save tons of money during your No-Spend challenge period.

Here are things to keep in mind when identifying your spending triggers:-

Environment: – the environment you are in can motivate you to spend. So when in such an environment, try to be cashless.

Time of the Day: – if you’re prone to buying things online in the middle of the night, you can prevent this can getting yourself occupied every night.

Friends: – if you’re more inclined to spend time around friends, read this article’s fifth idea.

5. Tell a Friend About the Challenge

Allowing a friend to participate in a challenge is one of the best methods to achieve success with your no-spend challenge.

You’ll be able to extract spending triggers as well as add a factor that will police your activities during the No-Spending Challenge time in this manner.

If your buddy cycle significantly influences your spending, you will struggle to complete the No-spending challenge unless you inform them of your saving goal.

As a result, whenever you decide not to accompany their little adventures, you will gain their understanding.

And, as you know, friends sometimes go a little too far in assisting you in reaching your goal.

So perhaps you might notify that one buddy who will either join you in the challenge to offer support or ensure that you stick to a No-Spending regimen.

6. Open a Certificate of Deposit Account

Various types of bank accounts might assist you in keeping your money safe. A certificate of deposit, on the other hand, is not the same thing.

It not only keeps your money safe, but it also prevents you from making redraws until a certain period has passed. Having a good knowledge of how certificates of deposit work will help.

So, if you’re thinking about joining the No-Spend challenge, opening a certificate of deposit account is a terrific method to save money that might otherwise be spent on frivolous purchases.

However, before considering this option, remember that you can only open a certificate of deposit account if you need to save for a long time.

7. Keep your Credit and Debit Card with a Friend or Family

This no-spend challenge idea may appear excessive, but it is a very smart method to scale through a No-Spending challenge period if the other alternatives do not work for you.

First, compile a complete list of all the major expenses you incur each month.

After that, load your prepaid card with the exact amount needed to get you through the month.

If you cannot obtain a prepaid card, simply redraw the funds and keep them as cash.

After then, give your credit/debit card to someone you trust with the request that it not be returned until a certain date. As a result, your spending options will be limited.

Remember to disable your mobile banking service as well.

8. Unsubscribe from Shopping Related Newsletters

It isn’t easy to stay focused on a goal when everything around you gives you reasons to give up.

So, if you’re hoping to save a lot of money by participating in a No-Spend challenge, always remember to delete anything that could serve as a temptation.

Because internet shopping newsletters fall into the temptation category, you must unsubscribe from them.

This strategy will keep you focused on the money-saving goal at hand.

If you fear you won’t be able to resist the temptation to resubscribe to your favorite shopping newsletters, turning off your mobile banking will prohibit you from completing online purchases.

9. Have a Special Purpose Piggy Box

The use of piggy boxes to save loose change has recently gained popularity. People are starting to adopt this form of saving to save up for something they want.

With that in mind, you can purchase a piggy box to assist you in saving money while participating in the No-Spend challenge.

The piggy box will function as a repository for any money that should not have been spent.

In other words, every time you decide to buy a drink, put the money into your designated piggy bank.

10. Use a No-Spend App

When doing the No-Spend challenge, it’s easy to lose account of your spending and savings.

But apps like Quicken and Mints can help you identify where you need to cut down on your spending as well as give you personalized advice that can help you save tons of money.

For example, Habit Bull Tracker. While you may potentially use this software to track any habit you want to develop, it also works for a no-spend challenge.

You enter the habits you want to track and then check the box each day that you did it. In response to your challenge? Your behaviors could include the following:

- Spending no money

- Not going into a store

- Not browse online stores Etc.

- It also tracks your progress (daily streaks) and tells you how many days in a row you’ve done your habit.

Other No-Spend Challenge Ideas to Save You Money

Swap and Barter

Look into the possibility of trading with friends, family, or neighbors rather than purchasing brand-new items.

You don’t have to spend money to trade books, clothes, household things, or even services.

DIY Gifts

Instead of buying gifts for special events, you could make your own gifts that are personal and thoughtful. This can save you money and give your gifts a special touch.

Use Free Resources in Your Neighborhood.

Make use of libraries, community centers, parks, and other free resources in your area. Borrow books, go to free workshops or events, and go outside to do things that aren’t expensive.

Repair and Reuse

Before you buy something new, try fixing or reusing something you already have. By fixing broken things or finding new ways to use them, you can make them last longer and save money on buying new ones.

Use Cash-back and Reward Apps

When you need to buy something, make the most of cash-back and reward apps. These apps give you cash back, discounts, or prizes when you purchase certain things, so you can save money or get perks.

Host Potluck Gatherings

Instead of going out to eat or getting leftovers, get together with friends or family and have a potluck. Each person can bring a dish, which will cut down on their own costs while they eat together.

Take Advantage of Free Trials and Samples

Many businesses let you try out their goods or services for free. Use these deals to try out new things without having to pay for them.

No Spend Challenge is about being aware of how you spend money and coming up with clever ways to avoid spending it.

It’s a chance to put needs ahead of likes and find new ways to live on less money.

How To Start Your No-Spend Challenge

Starting a no-spend challenge with a no-spend month is a terrific way to get started. A month is a set time that isn’t too long. You can start with a day or a week if a month is too big for you.

As a result, you can concentrate on accumulating as many no-spend days as possible.

You can also arrange your no-spend month or week in conjunction with your budget. Use it to keep track of your monthly expenses and splurges.

The following are some crucial strategies to help you succeed with your no-spend challenge.

1. Time it Correctly

Choosing the proper month for your no-spend challenge might help you get started on the right foot. If beginning in January feels too hurried, consider another month.

Choose a month with no birthdays, anniversaries, major holidays, or other events where you know you’ll spend money.

Alternatively, plan ahead of time to purchase gifts to adhere to your no-spend agenda.

2. Keep a Journal to Record your Desires and Feelings.

The desire to spend is a difficult habit to break. Behavioral change is challenging, but it is not impossible! Keep a spending log and jot down any impulse purchases you have.

Explain how you feel and how purchasing a specific thing may make you feel.

For example, you could put down that you’re unhappy and that getting a new phone case will make you happy.

Do something else instead of spending money on something that will not make you happy.

Take time to reflect on what you wrote in your journal. Reading back through entries will teach you a lot about yourself.

For example, you may realize that wanting to buy five candles was your way of coping with anxiousness about a major work project.

3. Make Time Management Plans to Stay Productive.

When we are bored or in social circumstances, many of us squander money. You can avoid slipping into these traps by remaining productive.

Instead of going shopping with your pals, organize a clothing swap where everyone provides gently worn or brand-new items to exchange.

Consider free activities like reading a new book, going for a walk while listening to a podcast, or learning how to food prep.

Fill your calendar with enjoyable events that will keep you entertained while without tempting you to spend money.

4. Make it More Challenging to Spend

Consider your triggers if you frequently struggle to stay on budget.

Do you frequently overspend and make credit card purchases you can’t afford?

To avoid this, delete any saved credit and debit card information from online retailers.

Furthermore, you can keep your credit cards at a parent’s residence or with another trusted friend or family member.

You can also avoid unwittingly spending by leaving the house without money (or solely with cash for specified transactions).

Post about your no-spend month on social media to hold yourself accountable.

Making others aware of your difficulty is an excellent method to keep yourself accountable.

Share your progress on social media with friends, family, and those who will most likely follow your trip.

Better yet, see if any of your friends want to join you on the challenge so that you can support each other throughout the month of no-spending.

Taking several free finance classes might also help you connect with others and hold yourself accountable.

6. Keep a Visual Record of your Objectives and Progress.

There are temptations all around us. While participating in a no-spend challenge, you may begin to wonder what you’re losing out on.

You might wake up with the desire to go out to brunch with your buddies. Set up your environment to assist you before thinking your way into buying an unneeded purchase.

You can accomplish this by making visual reminders of why you’re participating in the challenge.

Creating a vision board of all the places you wish to see after the challenge can be motivating.

Another inducement is to have a cash jar in which you gather all of the money you save from the challenge.

Constantly reminding yourself of why you’re not spending and congratulating yourself on your achievements makes the process more fun and easier to complete.

7. Don’t Let Yourself off the Hook if you Make a Mistake.

You will make mistakes if this is your first time participating in a no-spend challenge. Shopping is simply a part of life.

Statistics show that even during periods of significant inflation, shoppers continue to spend money.

Recognize your error. Write it down in your notebook, tell your spouse or pals, and then go on. Don’t succumb to the desire to give up because of a single blunder.

Mistakes will be made in today’s environment. So, don’t give up if you accidentally buy a drink at a work happy hour.

Instead, mentally note the sum, stick to your original strategy, and keep going!

8. Set a Suitable Reward for Yourself After You Finish.

Setting a realistic incentive to commemorate your accomplishment is another motivational approach during your no-spend month challenge. Consider anything you spend money on that means the most to you.

Perhaps it will be a night out with your significant other or buddies. Maybe it’s a coffee date with your mother. Perhaps you’ve had your eye on a new book or clothing.

This reward should be both reasonable and meaningful. It’s all about having guilt-free entertainment money!

How a No-Spend Challenge Can Improve Your Finances

A no-spend challenge might help you save money by forcing you to avoid wasteful expenditures.

The beauty of a no-spend challenge is more about what you learn during this time than the money you save.

Here are some of the financial advantages of a no-spend challenge.

✅You’ll save more money

Of course, it goes without saying that decreasing unnecessary expenditures will result in more money in your bank account. Thus, being purposefully thrifty can be beneficial.

More money equals more capital for your new business, ideal vacation, or savings account. Your ability to save more allows you to achieve your financial goals faster.

✅ You’ll identify your bad habits

When you can’t spend money, you become acutely aware of how you’ve spent money in the past and those different habits of broke people you should be having.

For example, if you can leave the petrol station without purchasing any more snacks, you’ll notice how much extra money you finish up with.

Perhaps you’ll realize that going out for drinks during the week drains your bank account.

Perhaps it was purchasing another winter clothing that you didn’t require.

Whatever your bad habits are, a no-spend challenge will expose them quickly. With this insight, you will make smarter decisions and recognize how much money you have squandered.

✅You will get clear on your goals

You’ll feel enthused about your savings objectives as you start saving more and more money.

Remember when you intended to save for a 6-month emergency? How about that credit card you’ve been meaning to pay off?

When you decrease non-essential expenditure, the no-spend challenge might make these goals appear more attainable.

✅ You’ll find new ways to fill your time

Spending money consumes a significant amount of your time. It’s usual to go shopping, rent movies, or order meals when you’re bored, even if you’re not hungry.

You’ll have more time for other fun pursuits if you’re not allowed to spend money. Perhaps you should dig out your old acrylics and start painting.

Alternatively, you may clear out your closet and find some clothes to sell.

When your hands are free of your credit card, you can use them to do things that are important to you.

No Spend Challenge Tips To Save You A Ton of Money

Save or invest the unspent money.

Plan ahead of time what you’ll do with the additional money you’ll save during these trials.

That way, you won’t be tempted to spend all of your newfound savings on frivolous items or abandon your challenge halfway through because you’re not convinced it’s worth it.

Perhaps you want to pay off your credit card debt, increase your emergency money, save for a new automobile, relocate to a nicer place, or begin investing for the first time.

Whatever it is, knowing your “why” before you begin your challenge will help you stay motivated and enthusiastic as you progress through the no-spend challenge phases.

Start small with a realistic challenge.

Challenges with no spending limits are not for the faint of heart.

Don’t rush into a 90-day no-spend challenge if you’ve never even attempted a 24-hour challenge!

Remember that it is usually simpler to extend a little and successful task than it is to face the letdown of giving up on a large and overwhelming challenge.

If you’re new to no-spend challenges, be gentle with yourself and start small!

Tip #1: Limit your exposure to temptations.

I’m unsure about you but learned to despise advertising emails. Maybe it’s because I see right through their ploys to get me to spend money quickly with one-time specials and time-sensitive promo codes.

I’m not buying it, and neither should you!

Spend some time unsubscribing from every promotional email that arrives in your inbox.

Delete any previously saved credit card numbers from your computer so you can’t buy on the spur of the moment.

Avoid going to stores during the no-spend challenge that will have you screaming, “TAKE MY MONEY!”

If you have any other known temptations in your life (for example, a regular brunch with your pals where you typically buy too many mimosas), keep them hidden during a no-spend challenge.

When your challenge is finished, you may discover that eliminating those temptations from your life is better for your money and easier to give up than you previously anticipated.

Tip #2: Get a no-spend challenge tracker.

You can easily keep track of your spending and categorize transactions to ensure they fit your no-spend criteria by linking your accounts to applications like Rocket Money.

Take an inventory of your possessions. Making a list of what you already own will assist you in avoiding purchasing goods you don’t truly need.

Tip #3: Make use of gift cards.

Spending money with gift cards means you’re not spending as much on your own.

Take your banking information off your phone.

Making impulsive purchases may be less tempting if your credit card or banking information is not saved in your browser.

Tip #4: Include your family.

Tell your partner or children about your no-spend challenge so you can all participate together. Even better, make it a game to keep everyone interested!

Set a target for how much money you want to save, and then keep track of your progress.

When you’re finished, you can award little rewards to family members who save the most.

To ensure that you maintain all of your money, look for free or low-cost methods to reward your family, such as a day off from chores or an additional topping on Friday night pizza.

Tip #5: Find someone to hold you accountable

Consider joining a no-spend challenge with your friends or publicly documenting your success (such as on a social media platform) to help you remain on track.

Tip #6: Work on a side project to keep yourself occupied.

If you’re anything like me, you have about ten side projects that you keep dragging down your to-do list.

Why not make time for those activities while you’re not spending money? During a no-spend challenge, some of the favorite things to do are:

- Decluttering your home and selling whatever you don’t want.

- Cleaning up your social media accounts by unfollowing people that make you unhappy or tempt you to spend money you don’t have.

- Going to the library to get some good novels.

- Making a puzzle.

- Working on a side project.

Other no-spend challenge tips to help you are:

- Take an inventory before the month begins.

- To arrange your rules and goals, use a no-spend challenge printable.

- Make a meal plan. Look for methods to repurpose the goods you already own.

- Find free fun activities in your neighborhood.

- Make a list of things you can do for free during your no-spend challenge.

- Make use of leftovers and cupboard goods to get creative in the kitchen.

- Experiment with side hustles to improve your income without spending money.

- Inform others about your no-spend month for further accountability.

- Learn how to live a frugal lifestyle that allows individuals to live well without spending money.

- Ensure everyone in the family understands the plan and why you’re doing a no-spend month.

What Are Some Activities That Are Free During a No Spend Challenge?

Find free activities to do during this challenge instead of spending money at the mall, the theater, or anywhere else.

You and your family can go to nearby playgrounds. Look for local parks in your region that provide hiking and biking routes.

Attend any free festivals where you can make memories while having fun.

Don’t forget to hunt for free museums and other inexpensive things to visit in your neighborhood.

The no-spend challenge is an excellent method to become more aware of your spending habits and to avoid making unnecessary purchases.

It can also be utilized for self-reflection, which will help you make better judgments when buying stuff in the future.

And if you’ve been struggling to keep to your budget or save money, this could be precisely what you need!

Rewarding Yourself for No-Spend Challenge will Motivate You

You must reward yourself once you have completed your no-spend challenge. Of course, nothing extravagant.

For example, you can have a hot fudge sundae or an ice cream party at home with your family.

But have some fun, and if you’re doing it with family or friends, talk about what went well and what didn’t.

“Explain your experience. “The first couple of days will be difficult, but once you get through that, it will get easier and easier,” he explains.

And, if all goes well, you’ll soon have another job to complete: choose how to spend the money you saved during your no-spend challenge properly.

Good Read: 12 Best Mobile Coupon Apps to Save Money Shopping with Your Smartphone

Bottom Line

Completing a no-spend month is an excellent way to start a new year, season, or month by preparing yourself for financial success.

Plan ahead of time, think of methods to minimize your spending triggers, and share the good news with family and friends to make your no-spend challenge as easy as possible.

If you enjoy performing challenges to help you with your finances, you should try savings challenges as well as a no-spend challenge! Whatever you decide, a 30-day money challenge can help you better your life and your finances!

Sticking to a No-Spend week or month may seem impossible when things aren’t going well. Fortunately, the ten simple No-Spend challenge ideas listed above will help you on your way to financial independence.

Frequently Asked Questions

Q: Does a No-Spend Challenge means I can’t spend?

A no-spend challenge is not a spending delay. A no-spend challenge is a waste of time if you’re merely waiting to buy what you intended to buy but didn’t during the challenge. While this isn’t a problem if you’re vowing not to eat out with friends for a month, if you commit to not purchasing a specific type of thing for a length of time, you can’t simply compile an I’ll-buy-this-later list, or you’ll ruin all the monetary gain of your self-denial.

Q: How Can I Go a Month Without Spending Money?

Going a month without spending may be difficult. You’ll realize it’s a lot easier than you imagined to live without overspending after you get used to dining at home and finding pleasant things that don’t cost you anything. Taking on this challenge will help you become a much better budgeter in the future.

Q: What Can You Pay For During A No-Spend Challenge?

Living expenditures, essentials, and bills that you can still pay for during a no-spend challenge include:

- Payments for rent or mortgage

- Electricity, gas, and internet bills are examples of household bills.

- Transportation and gas costs

- Groceries

- Health-care expenses

- Your community or family obligations

You can continue with automatic withdrawals to another account if you have specific savings goals, such as sinking funds for the holiday season.

Q: How to Do a No Spend Challenge + Printable

Do you believe you spend too much money each month? It’s difficult to go ahead if you don’t keep track of your expenses and spend a lot of money on useless things like eating out. If you want to improve your ability to save money for a savings account, you should try a no-spend challenge. You can use the downloadable to get started quickly on becoming more financially comfortable.

Q: How long should a No Spend Challenge last?

The length of a No Spend Challenge is determined by personal taste and goals. It can be a one-time challenge for a week or a month or a long-term lifestyle change. Choose a timeline that is manageable and achievable for you.

Q: What if I need to make a necessary purchase during the challenge?

In some cases, you may need to make necessary purchases during a No Spend Challenge. Consider each purchase carefully and prioritize your requirements. Consider seeking less expensive options, shopping sales or used, and practicing mindful spending.

Q: Can I spend money on necessities during a No Spend Challenge?

A No Spend Challenge typically focuses on cutting back on non-essential spending. You can still spend money on necessities like food, shelter, utilities, transportation, and health-care. The purpose is to assess and reduce discretionary spending.

Q: What Should You Avoid Spending Money On?

Any non-essential expenses should be avoided throughout your no-spend challenge.

- Clothes are one of these products.

- Furniture and home decor

- Takeout and dining establishments, including coffee shops

- Online purchasing Amusement (such as going to the movies)

Of course, exceptions exist, such as if you desperately need to replace a broken chair in your dining room. If you don’t need it immediately, avoiding it throughout your no-spend challenge is advisable.