Last updated Apr. 18, 2023 by Benedict Osas

There are many investment strategies available, and they are usually classified depending on their overall objective, like regular income, rapid growth, low risk, and so many others.

Your investment strategy will determine the kind of investment choices and decisions you make for your investment portfolio. One of these investment strategies is Seasonal investing.

If you’re hearing about this investment strategy for the first time or you’ve heard about it and want to know more, then you’re at the right place.

In this article, we will discuss seasonal investing, how it works, and everything you need to know about the topic. So, continue reading because this investment strategy is worth learning about.

What Is Seasonal Investing?

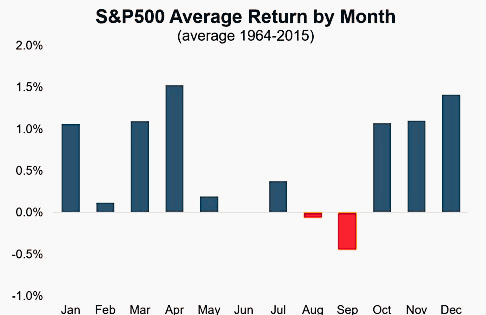

Seasonal investing is an investment strategy that guides an investor to bet on some stocks and sectors using historical performance to forecast how these stocks and sectors will perform.

Regarding this investment strategy, similar recurring trends are identified and based on those stocks and sectors that have performed very well in a specified period in the past. They are then bet on again in the present during the same period that they will do the same.

Let’s use an instance to understand better what seasonal investing means, but you should note that it’s just an example to clarify things, not the facts.

Let’s say tech stocks tend to perform better than the broad stock market from April to July or August, and then you can decide to invest in these stocks during this period to get higher returns on your investment.

Seasonal Investment Strategy

Seasonal investment strategies have been tested as far back as 10 to 20 years ago to confirm the performance of the stocks and recognize frequent trends. The market dynamics are ever-changing, so a well-known, profitable business today might not stay the same tomorrow.

So, it’s easier to anticipate the future and bet on a particular stock or sector that can perform better by looking at short-term and medium-term trends.

It’s recommended not to rely solely on seasonal analysis for historical data as the only investment strategy. You should also include fundamental and technical analysis for a more successful investing strategy.

How Seasonal Investing Works

If you want to do seasonal investing, you need to do research first. Therefore, it would be best if you researched very well, making use of legit sources with facts and figures, and then studied the trends for certain sectors and the period when certain sectors performed better than others.

After your research and study, you will be able to tell which sectors you can invest in for a certain period to get better returns on investment.

While, on the one hand, seasonal investing can be a very good investment strategy as there is past data to back up your selective investment strategy, on the other side, you should know that future occurrences can be accurately predicted.

Even when their historical performance is seen as other factors involved, the stock market is highly dynamic.

Why Seasonality Occurs In The Financial Market

The Financial market is ever-changing since it is composed of different types of humans with sentiments. While some may think that seasonality in the financial market is a mere coincidence, others believe there are certain reasons for it, most of which tend to revolve around humans.

Humans’ mood at different times tends to affect their spending habits. For a lot of people, intense emotional feelings can result in too much spending. Most activities carried out by humans have a seasonal cycle, and demand usually changes during the year when there are severe climatic conditions which is why some stocks will boom during the summer months and some in the winter months.

Change is very certain, so there will always be changes in the supply and demand of a financial asset, no matter what. And this results in seasonality in the financial market.

The period of the news release is also a reason for seasonality in market trends. For instance, periods when companies’ quarterly financial statements are released, are known to result in increased interest.

- Identifying Seasonal Trades. There are different methods to identify the periods of seasonal strength so you can take advantage of them. These methods include:

- Data that’s been available for ten years or more can be screened to know equities and sectors that are showing periods of above-average strengthening in their benchmark index.

- Comments made by fundamental analysts on seasonality can be authenticated by completing a seasonality report. This report is usually based on historical data of 10 years and above. Few fundamental analysts know long-term seasonal trends extremely well and base the timing of their recommendations slightly on seasonality at the very least.

- Using ten years and above data, you can also look at recurring spikes on the monthly price chart. If you notice regular spikes at the same period each year, either on the upside or downsides, then there’s a possibility of a seasonal trend.

- You can also look at companies and sectors to see the specific period in a year when they are seasonally strong. Seasonal strength in share prices usually starts and ends before their period of seasonal financial stability. For instance, airline companies are seasonally very strong in the summer.

With the regularity of seasonal patterns, all you can do is research, study, and identify these patterns to take advantage of them. However, you should also know that, similar to other market patterns, and it doesn’t offer certainty.

Pros of Seasonal Investing

There are several benefits involved in seasonal investing, and they include:

- Availability of data

Seasonal investing is hugely dependent on historical trends. There are many historical performances and stock trends readily available and accessible. In addition, these seasonal periods are popular, tracked, and on records, so the past trends have much data to back future predictions up.

- A limited holding period

Since seasonal investing strategies only last until the trends. And these trends are usually less than a year. This benefits you as an investor because it provides higher liquidity, and you can look out for the next trend.

- Ability to maximize Profits

Seasonal Investing involves buying stocks at the beginning of the trend at lower prices and selling at the end of the trend at higher prices. Buying and selling these stocks at the right time during seasonal trends allows you to maximize profits.

Cons of Seasonal Investing

There are also certain downsides to seasonal investing, and these include:

- Wrong timing can make you lose money

With this investment strategy, timing is essential to maximize profits. Unfortunately, any little mistake with entry or exit time may lead to losses. So you’ve got to be diligent and research properly to avoid any mistakes with the timing.

- Time-intensive research

As an investor, you’ve got to carry out research to perform seasonal Investing extensively. You have got to stay up to date with the market trends to turn to this strategy, and this is very time-consuming.

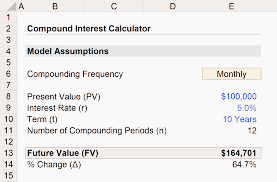

Compound interest Calculator

Compound interest is the interest on a loan or deposit calculated based on both the initial principal amount and accrued interest over the past period.

Since compound interest involves interest accrued in the previous period, it grows at a very rapid rate causing your loan or deposit to grow faster.

There are several compound interest calculators, and you can use Microsoft Excel to calculate demanding compounding tasks or use any free online compound interest calculators like Financial-Calculators.com, Investor.gov, or TheCalculatorSite.com.

What Is TSP Seasonal Strategy?

Most popular investment strategies and methods couldn’t be applied to retirement funds such as TSP, which is why the concept of seasonal investing is gaining ground.

As seen in data and research, TSP’s seasonal strategy involves investing in TSP funds based on its historical performance. It primarily takes advantage of its favorable period to make higher returns.

The strategy involves taking advantage of the seasonal tendencies of the market.

Research shows that small-cap funds like the TSP funds are the best prospect for seasonal strategies. It also helps that this strategy is very easy to execute as it requires just two allocations in a year and over the full market cycle.

This strategy has consistently outperformed and brought better returns than the buy and hope strategy. The policy also helps to minimize your market exposure as an investor by earning interest in the off-season and avoiding the weakest period in the year.

What’s The Importance Of Keeping Seasonal Stock?

There’s a season to everything, including the stock market. So seasonal stock market trends can provide you with potential trading opportunities.

Seasonal stocks are stocks that have a favorable period in the year where they outperform.

A stock representing a seasonal industry will most likely boom during certain times of the year and may probably be inactive during the off-time of the year.

Although you will need extensive research and analysis as an investor, you can take advantage of the seasonal stock. The importance of keeping seasonal stocks can range from being an efficient way to use historical data as you review stock charts.

Another perk is that you can come across stocks with high seasonality.

So, once you notice a similar recurring trend for years in a row, you can just hop on it at the time when it’s traditionally low and sell when it’s peaked before it dips again.

In addition, looking through the seasonal trends helps to exploit earning interest in the rising and falling of seasonal stock. However, you should have in the back of your mind that just because something has been happening for many years in the past doesn’t mean it will happen again in the future.

This is why seasonality is just one out of everything to consider during your market research, and there are other things to consider.

What Is a Seasonal Stock Return?

Seasonal stock returns are permanent periodic patterns in stock returns to investment strategies that are dependent on prior performance.

Seasonality in stock returns results from recurring patterns in asset classes, usually in specific periods in a year, but it doesn’t necessarily have to do with the seasons.

While there’s a high level of win associated with this recurring pattern, it doesn’t mean it will be a winner every single time because some other factors, such as a significant change in trend, can suddenly change this pattern.

How Much Will My TSP Be Worth When I Retire?

Financial experts recommend that you have a $250,000 balance by the time you retire so that it can generate an inflation-indexed annual income of $10,000.

However, your TSP worth when you retire will depend on certain factors, such as your time horizon, which is your current age, your expected retirement age, and how much you’re maximizing your TSP account to get the most out of it.

Frequently Asked Questions On Seasonal Investing

The following are more questions asked by people who want to know more about seasonal investing and our answers to them. You may read on to learn more about the topic.

What Is Seasonal Stock?

Seasonal stocks are high in returns during specific times in the year. The stock market is frequently changing.

There are usually certain times in the year when these stocks outperform their usual performance. For instance, in the summer, when cars are used more for vocational purposes, gas prices rise, so the stocks of oil refining companies are more likely to rise during this period.

Why Do Stocks Go Down In December?

The stock market is subject to seasonal changes that, at certain times in the year, share prices could rise or fall. Stocks tend to go down in December when investors engaging in tax loss harvesting, prompts a sell-off to offset realized capital gains.

Going Forward

Seasonal investing relies on the past performance of stocks and sectors to predict potential future events. As they’re short-term, they allow you to take advantage of multiple opportunities within just a year.

Now that seasonal investing has been explained to you, it will be easier for you to determine if it’s the ideal investment strategy.