Last updated Jan. 29, 2023 by Okechukwu Nkemdirim

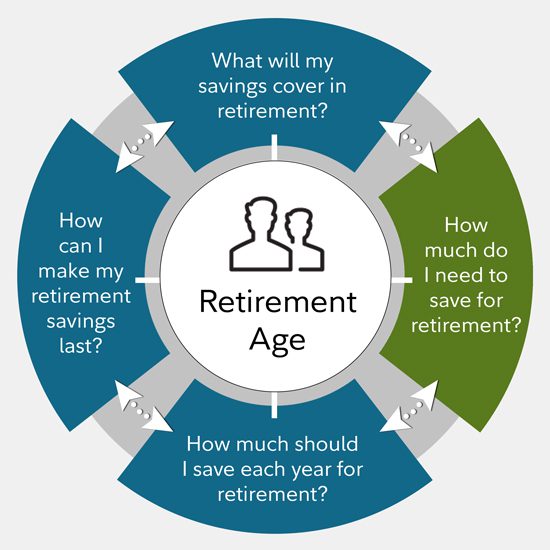

How much money do you need to have for a financially secure retirement? It’s never too early to take control of your retirement.

People do ask the question, how much money is enough for retirement? Several factors go into how much money you need to retire comfortably. Financial advisors often recommend

replacing about 80% of your pre-retirement income to maintain your current standard of living after retirement. If you make $200,000 a year, you should aim for at least $170,000 in retirement income in today’s dollars.

It’s essential to remember that all the money needed for retirement will not come from your savings. Here’s a guide to help you figure out how much money you’ll need to retire comfortably.

Establish Your Pre-retirement Savings

In knowing how much money is enough for retirement, a person’s ability to save for retirement cannot be overstated, and this is where your retirement planner comes in. After all, it’s what gives us the go-ahead. We must ensure that we have enough money to meet our basic needs and still have some leftovers to pursue our old-age comfortability.

The first factor in establishing is your retirement income, which will come from your pre-retirement income and savings.

Deciding the amount to save will not directly affect your retirement income. For instance, many United States residents want to retire with a minimum of $1 million in savings. However, this is not always the case. Hence, do not be too romantic about it.

How much money you need to retire depends primarily on whether or not you will have enough money to support your desired standard of living after you retire. Is it possible to generate enough income indefinitely with a $1 million savings account? Your pre-retirement payment is unnecessary because you can cut back on some of your expenses when you retire.

If you wish to spend your retirement years traveling, you should aim for a pre-retirement income of 90% to 100%. You can get by on less than 80% of pre-retirement income if your goal is to pay off your mortgage before retiring or downsizing to a smaller home.

Related article: Check out these cheap ways to cut your expenses

Reliable Sources of Income Such as Social Security and Pensions

Most Americans will get financial support from sources other than their retirement assets, such as Social Security income for their retirement. As a substantial source of income for the vast majority of the population, Social Security benefits are necessary for determining how much money is enough for retirement.

However, the percentage of income Social Security will replace is often lower for seniors with higher incomes. As a result, if you make $65,000 a year, you can assume that 35% of your payment will be replaced by social security. There is just an 11% Social Security income replacement rate for a salary of $300,000.

As a guide to future Social Security payments, examine your most recent statement or create a “my Social Security account” to see how much you can expect to receive.

Be sure to account for any pensions you may have accrued from prior or present employment in your financial planning. An annuity, which you acquire in advance of retirement, is another example of a long-term, reliable source of income.

If an older couple wants to know how much money is enough for retirement and wants to live comfortably in their golden years, they’ll require $12,000 every month. A $2,500 Social Security benefit for each spouse and a $2,000 pension are assumed. Non-savings sources can cover $6,000 per month of a $12,000 monthly budget.

Your Age Plays a Role in knowing How Much Money is Enough for a Retirement Plan.

We can only go by averages because no one has a definitive answer to that question. A man can expect to live another 25 years, or until he is 90 years old, according to the Social Security Administration’s projections at 67. If you’re in your 60s, you can live another 20.5 years or until 80 and a half.

Not to sound gloomy, but a lot of people underestimate how long they will live and overestimate the role age plays. If you plan your retirement so that you can live to the age of 80, your 81st birthday may not be as joyous as you’d like.

Consider how long your parents and grandparents lived when estimating how long you’ll need your savings. The only way you’re not getting there if you don’t look both ways when you cross the street is if you’re married and both sets of parents lived into their late 90s. For the most part, unless you know you’re in poor health, you should plan to live to age 90.

Determine your Monthly Retirement Income

Your monthly retirement income is a factor to consider in knowing how much money is enough for retirement. The formula for determining how much monthly retirement income you’ll need is as follows:

Monthly retirement expenses – Monthly retirement income from other sources = Monthly income needed

Now is the time to start saving for your golden years. Your retirement nest egg is the next step after determining how much money you’ll need to maintain a reasonable standard of living.

Using a retirement calculator can be an excellent first step in knowing how much money is enough for retirement. Alternatively, the “4% rule” might be applied. The “4 percent rule” allows you to withdraw 4% of your retirement assets in your first year of retirement.

It’s possible to take out $80,000 all at once or in installments in the first year of retirement if you’ve accumulated $2 million. Amounts will need to be increased each year as the cost of living rises during your retirement years.

To be able to retire comfortably, how much money do you require? Most importantly, it would be best if you were sure that your retirement income would allow you to maintain your preferred quality of living after you retire.

An alternative to worrying about running out of money in retirement is to adhere to a specific rule. Because of this, the 4% rule is designed to ensure that your money will endure at least 30 years. Start Using a personal capital retirement planner to set your retirement dates and social security strategies.

Related: Learn how to make $10,000 in a year

Savings Goal for Retirement is Equal to 25 Years of Annual Income.

To save $1.8 million in retirement accounts like Individual Retirement Arrangements and 401(k) plans, you’ll need to save $60,000 a year, or $5,000 per month, in retirement savings. This will be important in determining precisely how much money is enough for retirement.

There are various problems with the 4 percent guideline. You may expect to take out the same amount of money each year when you retire, indexed for inflation. It implies that your investments in stocks and bonds will always be equal, which is not necessarily the case.

Medicare, Charitable Causes and Legacy Considerations in knowing how much money is enough for retirement

Another cost that retirees overlook when checking how much money is enough for retirement is medical care. Medicare Part B has a standard monthly premium of $148.50 or more, depending on your income. Medicare covers the majority of doctor services.

In addition to the 20% of Medicare-approved costs for doctor visits and a $203 deductible, you’ll be responsible for the remaining 80%. Including long-term care, the average couple’s medical bills in retirement will cost $295,000 after taxes, according to Fidelity Investments.

Another consideration is how much of your estate you intend on distributing among your heirs and charitable causes.

How Do You Want to Live When You Retire?

Do you anticipate that your retirement expenses will be lower? That’s what we call a low-income lifestyle. Alternatively, will you keep spending the same amount? That’s the norm, and it’s not exceptional. It is above average if you expect your expenses to rise from where they are now.

Consider a hypothetical group of investors who intend to retire at 67. When he retires, Mark plans to downsize and live more frugally to save money. He may have a savings factor of 6x rather than 8x.

Because she intends to retire at the age of 67 and wants to maintain her current standard of living in her old age, Shelly has a savings factor of 8x. As Gary sees retirement as a time to travel extensively, he may want to increase his retirement savings and budget accordingly. At the age of 67, he has a savings factor of 10x.

Your Retirement Savings Target Can’t Be Calculated Perfectly.

It’s impossible to forecast your future income needs when planning your investments accurately and knowing how much money is enough for your retirement. A retirement planner app is recommended. The fact that not all retirement plans are equal in terms of income is also worth noting.

The money you take from a traditional IRA or 401(k) is taxable. However, the money you take out of a Roth IRA or a Roth 401(k) is generally not taxable. This may slightly alter your retirement calculation.

It’s not the only thing to consider. This means that many people are being forced to retire earlier than they had initially planned. The COVID-19 pandemic led to the premature retirement of about 3 million workers.

Due to layoffs, health issues, or caregiving responsibilities, many older workers are forced to retire early during regular times. Having a safety net like a good budget for a longer retirement than expected is a wise financial decision.

The impact of inflation on your retirement plans must also be considered. In 2022, inflation has received much attention because prices have risen at the fastest rate in 40 years.

Even if prices rise at a typical rate, inflation will significantly impact elderly households more than working-age ones. As a result, healthcare and housing expenditures for the elderly tend to increase more quicker than the total inflation rate of the population as a whole.

The bottom Line

You should seek advice from a financial advisor if you’re trying to save for retirement because they can help you personalize your goal to your situation. Your financial supervisor can use his expertise and different financial tools to determine precisely how much money is enough for retirement.

The financial advisor will also steer you on the right track with an investment planner. You can utilize tools like an income and expense planner and a savings and investment plan. This guarantees you meet your retirement goals.”

Further Reading…

We are here to make sure you take complete control of your financial life. Check out this article on how to make your money work for you, cheap ways of earning free money. and investment success stories can .