Last updated Mar. 3, 2023 by Charles Zemub

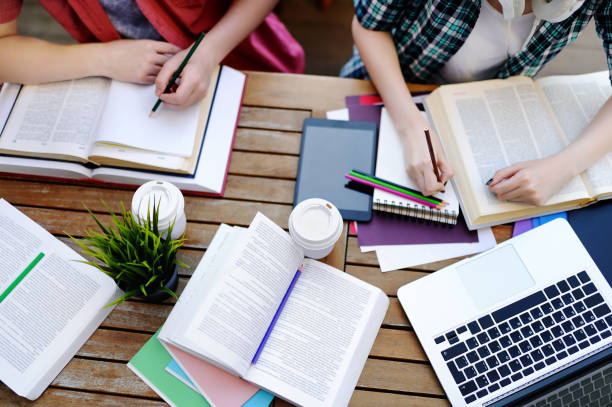

It’s never too early to teach your kids about money; these books are the best way.

“If You Made A Million.”

It’s a classic children’s book that teaches you about investing and the stock market. It follows the story of a young boy named Dan who wants to be a millionaire.

He learns about investing and the stock market through his grandfather, an investor. As a result, the book teaches kids how to save their money and how they can make it grow over time by investing in stocks, bonds, and other financial instruments.

This is one of my favorite books because it has excellent illustrations that keep kids entertained while teaching them valuable lessons about money management at an early age.

“The Money Tree.”

The Money Tree by Michael Leunig is a story of the power of saving and is told from the perspective of a young boy. The main character loses all his money at school and has to learn how to save up again.

His father teaches him how to save by placing a coin in a jar daily and adding it on top every time he adds more money.

“A Bargain for Frances.”

This book is about Frances, a young girl who finds a bargain in a store. She buys the item and brings it home to her mother, only to discover that it doesn’t work as well as advertised. “A Bargain for Frances” is a fun way to teach kids about money, value, and saving.

The story also teaches kids how important it is not to spend all their money on something just because it’s cheap or because someone else wants them to.

“You always make me buy things I don’t want,” Frances complained. “I bought you the doll,” her mother reminded her gently, “because I wanted you to have something nice.”

“Frederick’s Fables: A Treasury of 16 Favorite Leo Lionni Stories.”

In “Frederick’s Fables: A Treasury of 16 Favorite Leo Lionni Stories,” you’ll find 16 of the author’s most beloved stories. Each is about animals and contains lessons on money, friendship, honesty, and generosity. Some are about sharing, kindness, and self-control as well.

The book includes stories such as “When Will I Be Loved?” which explores how difficult it is to give something away when you want it so much yourself.

“A Drop Too Much” shows how easy it can be to lose your temper when someone does something irritating. On the other hand, Frederick’s Beautiful Garden” illustrates that sometimes you must work hard for what you enter.

“What Do Illustrators Do?”

This book is a great way to introduce the concept of self-employment and the importance of doing what you love. It’s also a great jumping-off point for learning more about art, illustration, and design careers.

This book is full of colorful photos, fun facts, and inspiration.

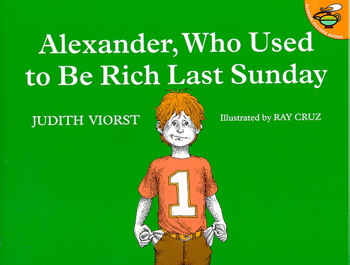

“Alexander, Who Used to Be Rich Last Sunday.”

The book is about a pig named Alexander who lives in a rich house with his parents and three sisters. His family owns everything they need, plus lots of extra things they don’t need.

One day, Alexander decides to do something fun with his money instead of saving it like everyone else in town. So he spends all his cash on toys, food, and other luxury items until he has nothing left but 100 pennies in his pocket – which he throws into the well because he doesn’t want them anymore.

After this selfless act of generosity, Alexander starts noticing all the good things around him: warm meals at home, a comfortable bed, nice clothes, friends who care about him, etc.

And while these things may seem insignificant at first glance (especially if you have never been without a theme, they are essential to him now that he knows absolutely what he likes.

“The Berenstain Bears’ Dollars and Sense.”

The Berenstain Bears’ Dollars and Sense by Stan and Jan Berenstain is a helpful way for kids to learn about money. It’s a book written in the ’80s but still has valuable lessons today.

You can find it at any bookstore or online retailer, including Amazon or Barnes & Noble. This book is recommended for ages 4-8 years old – depending on your child’s reading level more tricky; you may want to read it with them so they can understand what they’re learning more efficiently.

In this storybook, we meet Brother Bear and Sister Bear, who are having trouble understanding money (and even more difficulty saving it).

This classic story teaches children how to recognize different denominations of US currency so they’ll never be confused when dealing with cash again.

“The Best Way to Save Money.”

In The Best Way to Save Money, kids will learn how to save money in a fun and interactive way. This book features colorful illustrations and various activities and teaches children the importance of saving money and how to do it.

Kids essentially understand that not everything they want can be bought with cash. So if you don’t have the money right now, you might need to wait until later or do without.

Kids will also learn patience’s importance when saving money—you can’t just spend every penny you get immediately.

Best finance books

The best way to teach kids about money is to let them experience it.

Here are eight of the best books that illustrate the ups and downs of personal finance, so you can read with your child and talk about what they’re reading.

1. A Penny Saved: Confessions of a Serial Thrift Shopper by Ellen Bard

2. The Teen’s Guide to Money (Paperback) by Mary Hunt ()

3. Smart Kids with Money: Giving Them the Gift of Financial Literacy at Every Age by Joline Godfrey

4. When She Makes More: 10 Rules for Breadwinning Women by Farnoosh Torabi

5. Don’t Let the Pigeon Drive the Bus! (Board Book) by Mo Willems

6. The Berenstain Bears Learn About Saving and Spending by Stan Berenstain

7. What are You Worth? By Rebecca Epstein

8. What Color is Your Piggy Bank? By Rebecca Epstein,

Finance for kids

Finance is hard to learn, especially if you’re a kid. Study groups and classes can be intimidating, and even basic concepts are challenging to grasp.

But kids need to start learning finance early to develop good financial habits.

Here are some simple things you can do with your children that can help them get a leg up on their money management skills:

Talking about money when you’re spending it: Asking yourself, “What am I buying this for? Am I getting the best price?” will help your kids understand the value of each purchase.

Learning how to save money: Letting your kids put aside money for something special or fun will help them see the value in saving for their goals.

Earning money: Having part-time jobs helps kids understand how hard work can pay off when making cash.

Giving money: If you have enough, give some away—it’ll help your child see people needing help.

Frequently Asked Questions

How do I teach my seven-year-old the value of money?

Whether teaching your child the value of money or finding an easy way to spend time together, teaching them how to save is a great idea.

The simplest way to do this is by opening a savings account for them. But first, you can ask your local bank for an account in your child’s name, with a minimum balance of $25-$50 (or more if you like).

Then have them deposit their allowance into it every week. At first, they probably won’t understand why they must keep money in the bank when they could use it to buy more toys and games.

Explain that they’re building up their savings now so that when they need something that costs more than they have saved in the bank, they can buy it without asking you for help.

This is especially important at this age because these habits will ensure your child doesn’t grow up into someone who can’t make ends meet.

How do I teach my 5-year-old money?

Many parents wonder how to get their kids to understand the value of money. I believe that the best way to do so is through play.

When my 5-year-old son comes home from sch every day, he gets a small allowance (1-2 dollars) to put in his piggy bank.

He has a small piggy bank that he has used since he was three years old. We initially started giving him $1 per week, and now we give him $2 per week.

After putting his money in the bank, he goes to his room, where he plays with his toy shopping cart and brings me the toy or game that costs about the same amount as what he has in his account.

My husband and I then asked him if he could think of any other things that cost the same amount of money as what’s in his bank.

He then plays with the other kids and buys toys and games from them with his money.

We discussed what happened throughout the day at dinner time and what he bought from other kids with his money.

He also talks about how many pennies are in a dollar and how many nickels there are for six dimes.

What should an 11-year-old spend money on?

I think it’s not worth it for an 11-year-old to buy expensive things when they can enjoy more free activities.

If you have an 11-year-old begging for expensive things, try setting them up with a bank account at their local credit union.

Then, take them shopping for necessities like notebooks, backpacks, and school supplies.

You might even include gift cards so they can stock up on fun snacks and treats to keep them going all day long.

How do I teach my child to identify coins?

If your child learns to identify coins, you may wonder where to start.

First, ensure they’re old enough to hold and understand the coin.

They should be able to distinguish between coins and paper money. So you can give them one of each and ask which is which.

It’s also helpful if they recognize pictures of different presidents on the bills, so you can give them a few dollars and have them sort them by face.

If your child knows numbers, you can start by giving them a handful of coins and having them count the total. Once they’ve done that, try giving them one cash at a time and asking which number that coin represents.

If you can get it up to $1 (or 50 cents), you’ll have taught them how many cents there are in a dollar.

How do I teach my first grader about money?

First grade is a great time to start a child on the road to personal finance.

Encouraging kids to think about and practice money management helps them develop essential life skills like saving, budgeting, and spending wisely.

The earlier you introduce your child to these concepts, the more time they’ll have to practice them and develop good habits that will last a lifetime. For example, I’ve learned much about spending wisely in the five years since I started my savings account. Here are some tips for parents who want their children to learn those lessons early on:

1) Start Simple- You don’t need bells and whistles when teaching kids about money. You need basic knowledge. I recommend simple games that focus on counting coins. You can find free printable coin games here.

2) Choose Interactive Activities- The best way to teach your kids about money is by interacting with them as they play with their toys or do something else they enjoy. For example, pretend your child has $100 to spend at the toy store, and ask him what he’d buy if he had that much money.

How can a 13-year-old save money?

Saving money is a skill you learn over time, and it’s often something that takes a good amount of trial and error to master.

However, exploring possible ways to ensure your cash works for you is never too early. Here are some tips to help your 13-year-old start saving money:

As a 13-year-old, you’re probably just starting to get into saving money for specific goals.

One of the easiest ways to start is by creating a savings jar. You can put coins in this jar as you get them and then use them when you have a specific goal in mind buying a game or toy, buying new clothes, or even when you have enough for an item on your Christmas list.

If you want to save money, try setting up an account at a local bank or credit union. With an account, you can write checks (just like Mom and Dad!), which will help you budget your money more efficiently and avoid impulse purchases.

In addition, you can earn interest on your savings and get free checking with no minimum balance required.

Summary

Kids need to learn about money at an early age. Money is a topic that can be a little scary for kids since it involves numbers, but they need to understand how money works and how they can use it. These books are great for teaching kids about money in a fun way.

The stories are easy to read and entertaining, making it easier for kids to pay attention to their learning.

The illustrations are also child-friendly, so the reader will want to keep reading the story. This book is for older children who want something more challenging than picture books but still want easy-to-understand content.

These books can educate kids about money in a fun way. But, of course, the last thing you want is for your child to be scared of cash or intimidated by it, so they must learn how to handle their finances early on.

These stories will teach them valuable lessons on saving and spending wisely while entertaining enough to keep kids engaged throughout each level.