Last updated Mar. 9, 2023 by Peter Jakes

You’ve come to the right place if you’re seeking a budget template. We’ve compiled this list of 11 of our favorite free Google Sheets budget templates to help you track your spending more effectively and save money.

These unique templates provide users with something different and can best be utilized in conjunction.

DaveRamsey Google Sheets Budget Template

Dave Ramsey’s budgeting template is an excellent option for people who want to start budgeting but don’t know where to start.

It also has a feature that allows you to import your data from Mint.com, so if you’re already using that service and like their interface better, this could be a good choice.

In addition to these templates, plenty more are available on Google Sheets’ website, some of which are even more extensive than the ones listed here.

HomeZada Google Sheets Budget Template

HomeZada’s Google Sheets Budget template is a free budgeting tool that allows you to track your expenses and net worth.

The template allows you to chart your income, expenses, and net worth over time to see how well or poorly things are going in terms of saving money. It also includes sections for tracking bills as well as credit cards.

A few other features include:

- A section where you can write down what the different categories are in case they aren’t self-explanatory (e.g., “Food” or “Utilities”)

- An area with space for entering the name of each bill payment per month (e.g., “Rent”)

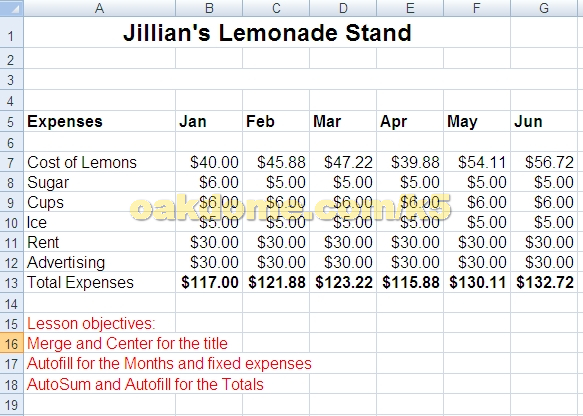

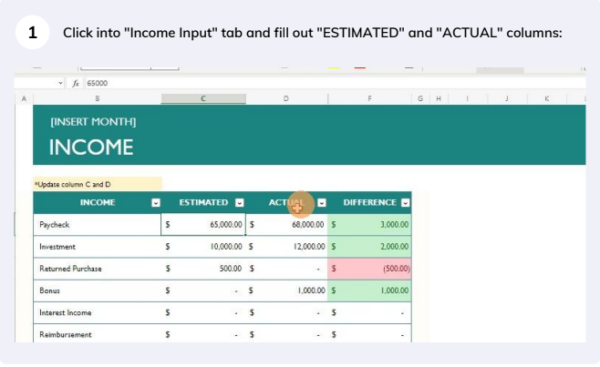

Make a Lemonade Google Sheets Budget Template

This free Google Sheets budget template is a great place to start if you want to get your finances in order. It’s simple and easy to use, with plenty of room for customization.

Print it or share it with anyone who wants to follow along. Updates are automatic.

Sell My House Quickly Calgary Google Sheets Budget Template

The Sell, My House Quickly Calgary Google Sheets Budget Template, is great for calculating the cost of selling your home, but it can also be used to calculate the cost of moving, renting, and buying a new home.

This sheet will help you determine how much money you need to sell your property quickly so that you’re not stuck paying rent or mortgage payments while trying to sell it on your own.

This template has everything that an average person needs when selling their house. The first section calculates all the expenses of selling a home: from cleaning up any damage caused by pets or children (or both) to advertising fees when listing online or through real estate agents.

The second part is where you’ll enter all relevant information about yourself, including your current income, previous years’ tax returns, and credit card debts that may affect how much money is available for these expenses before reaching out to family members or other investors who might want some extra cash during this stressful period in life.

Financial Mentor Google Sheets Budget Template

This template is best for beginners new to budgeting who want a simple, easy-to-use tool. It’s also free, so there is no need to worry about tracking down other templates that cost money.

Additionally, everyone can use this template since it’s available on Google Drive in English and Spanish (with very little translation required).

Mint.com Google Sheets Budget Template

Mint.com is one of the most popular budgeting tools out there, and with this template, you can use it to create a simple budget in Google Sheets.

The template is designed specifically for Mint users who want to track their finances on Google Sheets—so if you’re a Mint user and have never used Google Sheets before, this might be a great place to start.

Mint’s features include:

- Track your spending by category (e.g., groceries) and account (e.g., checking account).

- See where your money goes with easy-to-read charts and graphs that show spending trends over time.

Finances Made Simple Google Sheets Budget Template

This budget template is designed to help you get a handle on your finances. It’s easy to use, accessible, and available in multiple languages.

You can customize the spreadsheet with your partner to work for your needs.

Money Under 30 Google Sheets Budget Template

This template is based on the traditional budgeting method. You can review your spending place using this Google Sheets template, but it also allows you to separate each month into its tab. -This helps with checking past spending habits and seeing your progress from month to month.

The Money Under 30 template contains a savings goal option, which lets you set aside money for future purchases or save for emergencies.

It also has a debt reduction option that tracks the money saved by paying off debt over time. If either option isn’t relevant to your financial situation, delete them.

Mvelopes Google Sheets Budget Template

If you’re looking for an easy way to manage your money, Mvelopes helps you save money and stick to your budget.

The app allows you to set financial goals, track spending, and set aside funds for each plan. Mvelopes also has a free version that comes with some restrictions.

For example, the free version had several simultaneously.

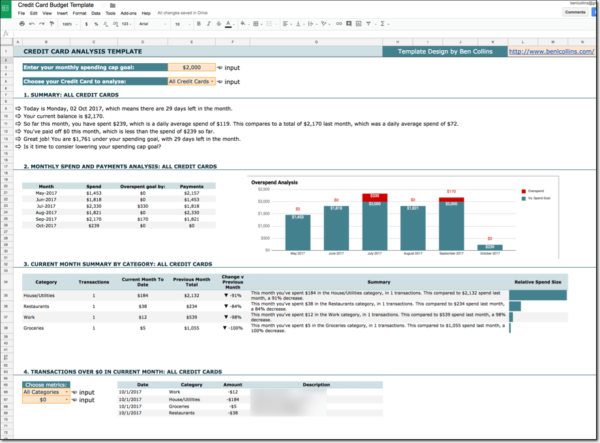

InvestmentZen.com Google Sheets Budget Template

- It has a straightforward interface and is easy to use.

- This budget template will help you track your investments to see how they perform over time.

- You can customize this template to suit your needs.

Free budget template

For everything you need to do in a month, it’s easy to make a free budget template.

A budget template can help you keep track of your monthly spending and saving goals. This post will discuss creating a monthly budget with an Excel spreadsheet.

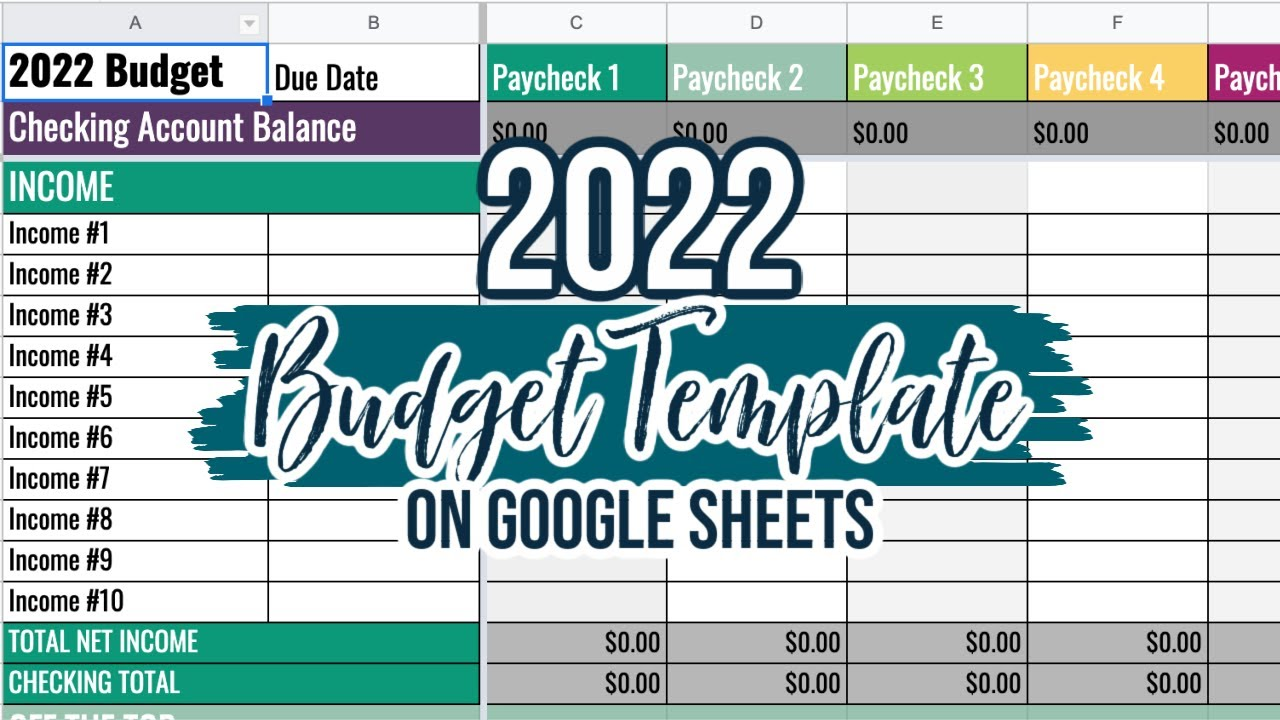

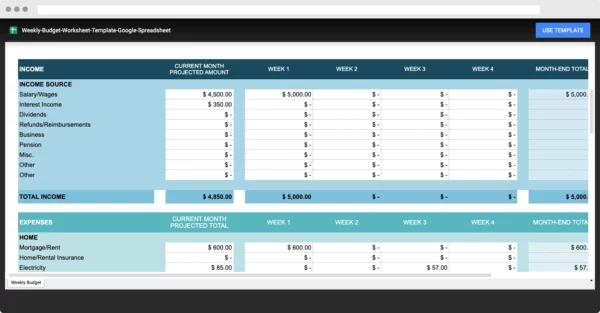

weekly budget template google sheets

Doing your accounting can seem daunting, but it doesn’t have to be complicated. If you struggle with what’s coming in and going out every month, this weekly budget template is a great way to make things easier for yourself.

The spreadsheet is set up in a way that tabs on your income and expenses for the week and generates a report at the end of the week that will show you how much you’ve spent.

It’s elementary to use and will give you a good idea of where your money goes each month.

Frequently Asked Questions

Is there a budget template in Google Sheets?

Google Sheets has no great budget templates, but two could be useful depending on how you plan to use them. A template is helpful if it’s comprehensive enough to trust that it’s giving you accurate numbers.

Unfortunately, template generators have difficulty covering all eventualities. They’re also not user-friendly if you want to tweak them to fit your style.

I’ve found that my favorite way to use budgets is to build my own from scratch. Some people like to plan their budgets on paper, then move them over into a spreadsheet program.

However, I p. Still work directly in Sheets because entering data is much easier for me than writing it down or making the calculations by hand. In addition, this method lets me get a good sense of where I stand at any moment.

If you’re doing something similar, here are two good budget templates:

One of these should work well for you; they’re both very straightforward and include everything one needs while being specific enough to customize easily.

What is the 50-30 20 budget rule?

The 50-30-20 budget rule is a guideline to help you reach your savings goals. The rule is simple: you should save 50% of your income and spend 30% on needs and 20% on wants.

The 50% savings rate is often heard when people talk about getting out of debt and saving for a house. You’ll listen to it on most financial planning shows as the magic number for financial stability.

Interestingly, this rule can apply to anyone who has a job and is making enough money to live on. So even if you’re not in debt or aren’t saving up for anything specifically, following this guideline can help ensure you’re smart with your money.

Does Google have a budget planner?

As part of an internal strategy, Google has implemented a budget planner for one of its departments.

The purpose of the budget is to offer a thorough overview of the company’s spending and provide a snapshot of where the company stands regarding cash flow.

The budget planner is designed to be easy to use by all employees and contains the most up-to-date figures regarding the company’s cash flow.

Although Google is one of the most profitable companies in the world, it has not always had access to a budget planner and has relied on more traditional methods to manage its spending.

How do small businesses use Google Sheets?

Small business owners have a lot on their plates. First, they work all day, then work some more to ensure the business runs as efficiently as possible.

So it’s no wonder they don’t have time to keep track of everything. But there’s an easy way for small businesses to keep track of their data, whether it be sales numbers, customer details, or just about anything else.

Google Sheets allows small companies to stay organized using spreadsheets, from one simple page to a custom list of columns and rows.

When you run a small business, you’re probably already familiar with spreadsheets—they’re the most popular tool among small business owners, according to a recent report by Google.

Spreadsheets allow you to organize data in an attractive format that can be easily edited and updated—but the truth is that spreadsheets aren’t exactly known for being user-friendly or beautiful.

Nevertheless, you can create a spreadsheet in Excel, Google Sheets (or any other spreadsheet program) and customize it to work best for your business needs.

Here are some examples of how small businesses use Google Sheets:

A restaurant owner might keep track of menu items and ingredients to know when she needs to order more from the grocery store.

How do I weekly budget on Google Sheets?

Google Sheets is the perfect tool to keep track of your weekly budget and let you know how much money you have left to spend each week. It takes just a few simple steps to get started:

1) Download the template

2) Enter your income, expenses, and savings for the previous week

3) Enter your income, expenses, and savings for the current week

4) Check out a summary of your budget in the “Dashboard” tab

How do I track a budget in Google Sheets?

Google Sheets is a fantastic tool for budgeting and creating a financial spreadsheet to track your spending. One of the best features of Google Sheets is its ability to track formulas and numbers automatically.

-This means that once you’ve created a sheet with all the appropriate categories, it will continue to add up your expenses and income by typing in numbers in the proper cells.

However, you must first add some formulas to your budget sheet to use this feature.

Summary

These unique templates provide users with something different and can best be used together.

Each template is fantastic but can be used in conjunction with one another to help you understand how to use another template.

For example, if you want a more detailed budget that breaks down your expenses by category, then using the “Budget Planner” and “Free Personal Budget Template” would be ideal.

On the other hand, if you need a basic budget that covers all of your costs per month (as opposed to breaking them down), then using the “Budget Planner” and “Spreadsheet Budget Template” would work well for your needs.

We hope you enjoyed reading the details of these free Google Sheets budget templates.

As you can see, there are to create a budget using Google Sheets, which will help keep your finances in order. Just remember to use one or more templates in conjunction with one another for the best results.