Last updated Mar. 5, 2023 by Peter Jakes

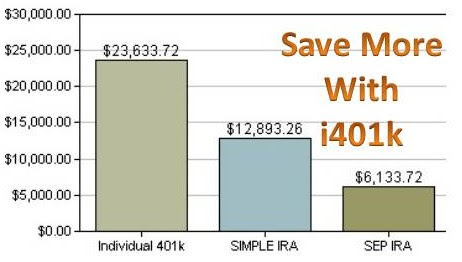

A solo 401k is a great way to save for retirement if you run your own business. It provides the ability to contribute more money than other retirement accounts.

It often comes with additional benefits such as matching contributions from your employer or a self-directed investing option that lets you choose investments based on your risk tolerance and future goals.

Best Solo 401ks Overall – Self-Directed Solo 401k

A self-directed 401k is the best option if you want complete investment control. It allows you to invest your money in various assets such as stocks, bonds, mutual funds, ETFs, real estate, and alternative investments.

The self-directed solo 401k allows you to invest in various investment vehicles, including mutual and exchange-traded funds (ETFs).

Moreover, it allows you to invest in alternative investments like real estate through a self-directed IRA LLC or an IRA trust.

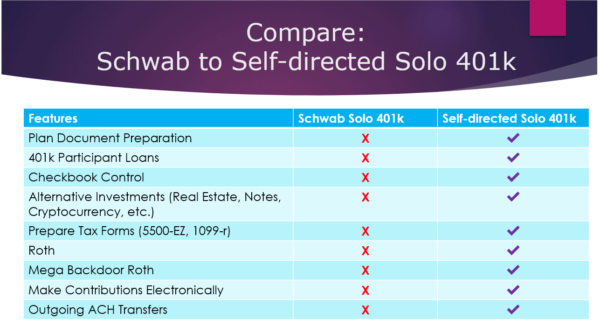

Best Solo 401k for Straightforward Investing – Schwab Solo 401k

Schwab Solo 401(k) is an excellent option for those looking to invest their retirement savings in straightforward terms. It’s one of the most popular solo 401(k) plans, offering a long list of investment options and advice services.

To start, Schwab Solo 401(k) has low fees: It only costs $1 monthly (and no maintenance fees). Plus, there are no account minimums or complicated pricing structures—you pay based on how much you have invested with them.

In addition to these excellent features, Schwab offers a wide range of investment options—including ETFs (exchange-traded funds), mutual funds, and individual stocks—and access to financial advisors via phone or video chat.

Best Low-Cost Solo 401k – Vanguard Solo 401k

Vanguard’s Solo 401k is one of the least expensive options available on the market. There are no trading costs or management fees, so your investments will grow tax-free consistently.

There are also several investment options to choose from, and you can use any broker that works with Vanguard or roll over your existing IRA into a Vanguard Solo 401k plan.

- No minimum balance requirements or account service fees

According to Vanguard, you don’t have to maintain a certain amount in your retirement account for it to remain active. You won’t be charged annual and no account maintenance fees either.

The only thing that could cost money is if funds are left in the plan when you stop working as an independent contractor. Then, they may charge an inactivity fee until you retake action on them (which could easily be avoided by moving those funds elsewhere).

Best Flexible Self-Directed Solo 401k – Fidelity Go Self-Employed 401(k)

If you want to be able to invest in a wide range of investments, the Fidelity Go Self-Employed 401(k) is a great option. You can invest in stocks, bonds, mutual funds, ETFs, and REITs.

The catch? It has limited investment options available for real estate if you’re looking for something flexible with opportunities for real estate investing. However, this is one of the best solo 401k plans out there.

Fidelity Go allows investors to purchase residential and commercial properties with their solo 401k plan through a Fidelity Real Estate Investment Trust (REIT).

Investors participating in these plans can even borrow up to 30% of their total account balance when purchasing property – so if your account value was $100K and you wanted to borrow $30K from yourself, then that would mean that you could use $130K worth of funds from this one account – not bad.

Best Low-Cost Self-Directed Solo 401k – TD Ameritrade Self-Directed Brokerage Account Solo 401(k)

TD Ameritrade is a low-cost brokerage that offers some of the best mutual funds and ETFs on the market. One of their most popular products is the TD Ameritrade Self-Directed Brokerage Account Solo 401(k) because it has a low minimum investment requirement, a low $10 per month fee for the account, and no trading fees!

If you are looking for an inexpensive way to invest in your business without hiring someone else to do it for you (and possibly pay them a hefty fee), this option might be perfect for you.

Best for No Trading Costs or Management Fees – Wealth front Roth IRA.

This account is excellent because it has no trading costs, management fees, or minimum balance required. There’s no account minimum or annual fee, account service, or transfer fee.

You also won’t have to worry about any inactivity or maintenance fees.

Best Solo 401k for Tax-Deductible Contributions – E*TRADE Retirement Plan Services Individual K Plan

This plan allows you to contribute up to $19,000/year (or $25,000 if you’re 50 or older). You can also set up a Roth IRA for the same account.

This is your plan if you have an E*TRADE Individual Retirement Account (IRA) with more than $1 million in total assets. Otherwise, it’s best suited for those looking for traditional retirement savings accounts and IRAs.

If your Solo 401k is connected with an E*TRADE checking or brokerage account like our online trading platform, then there’s another great way to maximize your retirement contributions: Roth IRAs.

Best Solo 401ks for Multiple Accounts or Employer Matching – Betterment Retirement Account (IRA)

Betterment is a Robo-advisor, so you can set it and forget it. You don’t need to worry about rebalancing your portfolio or monitoring the market: Betterment will do all that for you automatically. It also has no account minimums or account fees, which makes this solo 401k option very affordable.

Betterment offers a variety of investment options beyond stocks and bonds—including real estate and alternative investments like gold—as well as personalized advice from financial experts based on your goals, risk tolerance, and other personal factors.

Once they have those details, they can recommend the specific funds that make sense for you.

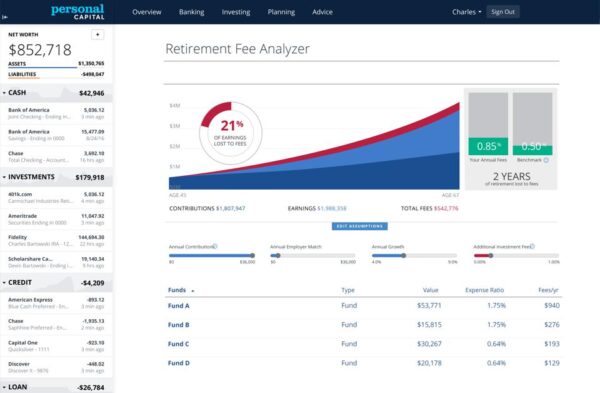

Best Interactive Investment Planning Tool – Personal Capital IRA Rollover Account

If you’re looking for an easy-to-use and affordable investment planning tool, look no further than Personal Capital IRA Rollover Account.

Personal Capital is a free investment management service that quickly helps users track their finances. It makes managing your retirement savings—whether in an IRA or traditional 401(k)—easy by providing both a tool to manage investments and alerts that let you know if something needs attention before it becomes a problem.

The Personal Capital IRA Rollover Account lets you easily transfer funds from your former employer’s 401(k) into this new account with just one click of the mouse.

And because all transactions are done online through their website or mobile app, there are no paperwork hoops to jump through either.

Best for Long History of Outperformance – Fidelity Personalized Portfolios IRA

Fidelity Personalized Portfolios IRA is excellent for investors who want to invest in various asset classes. Investors can choose from Fidelity’s managed portfolio options, including:

- Fidelity® Tax-Managed U.S. Equity Portfolio

- Fidelity® Low-Cost Municipal Debt Fund (LMMXX)

- Fidelity® International Index Fund – Investor Class (FIIIX)

Vanguard solo 401k

The vanguard solo 401k is a great investment option for self-employed people. A tax-advantaged retirement plan lets you put money into stocks, bonds, and mutual funds.

You can use it to save for retirement and withdraw some funds when needed, like in an emergency.

If you are self-employed and have set up your own business, opening up a vanguard solo 401k account can be a great way to save up for retirement because it allows you to contribute more than other plans allow.

Also, if you have been self-employed for at least two years, you can take a loan from the account for whatever purpose.

This can be helpful if you need cash for home improvement or medical expenses.

Another thing is that if you have a terrible year in business and earn less money than usual, the account helps give you some security because it insulates your earnings from taxes until you retire.

Also, unlike other plans, there is no maximum age limit for opening a solo 401k account.

So even if you are sixty years old and still working on your own business, you can still open up this account and fund it with money that will be taxed when you draw it.

E-trade solo 401k

Knowing what a Solo 401k it is important, and how you can benefit from using this retirement plan.

The Solo 401(k) Plan was created by Congress primarily for the self-employed.

It offers many of the same features as other retirement plans, such as a Traditional IRA or SEP IRA. Still, it has some additional benefits that make it especially attractive.

In particular, the Solo 401(k) offers two significant benefits: Self-employed individuals can contribute up to $52,000 per year to the Solo 401(k), which is tax-deductible; and

The account grows on a deferred tax basis until account withdrawals begin at age 59½.

The most significant benefit is that there are no income limitations on who can contribute and deduct their contributions.

You can open and fund a Solo 401(k) even if you have no employees or only one employee.

Frequently Asked Questions

What banks offer Solo 401k?

Several banks offer Solo 401k plans, and the list grows yearly. You’re lucky to bank with U.S Bank, Wells Fargo, or Charles Schwab.

These banks all offer excellent Solo 401k plans. Because you’re self-employed and not part of a company, a Solo 401k can be useful for retirement.

If you bank with one of these companies and open an IRA CD (or CD- ladder), you can save for retirement and watch your money grow over time — tax-free.

Can I put rental income in a 401k?

The short answer is yes. The longer answer is that it depends on the context. When discussing income from investments, a 401k is an investment like anything else. So if you can put your rental income in a 401k, why not leave it there?

However, there are tax implications to consider. Depending on your circumstances, you may be subject to taxes on the income as soon as it’s received.

Keeping your rental income outside the 401k until you’ve paid the taxes makes more sense if this is the case.

In addition, if your employer offers matching funds for your 401k but does not offer anything for Roth IRA contributions (which your rental income would likely go towards), you’ll want to keep your Roth contributions separate until after you’ve maximized the match in your 401k.

The bottom line: Yes, you can put your rental income into a 401k. And depending on your situation, it might make sense to do so. But there are some additional factors to consider beyond whether it’s allowed.

Is real estate a better investment than 401k?

Whether you believe real estate should be a big part of your investment portfolio depends on several factors, including the amount of money you have to invest, what kind of investor you are, and your goals for retirement.

“Real estate is an excellent long-term investment,” says Melissa Padgett, a financial planner in the greater Chicago area.

Looking at the numbers, it becomes clear that investing in real estate can help you build wealth over time and achieve your long-term financial goals.

Many people put at least some of their money into residential property, with most saying they bought their home. They liked living there as they did because they saw it as a good investment.

For example, if you’re buying a home that will become your primary residence, and you plan to live there for the next 30 years or more and think it’s likely that housing prices will continue to rise during that period, then buying a home could make sense for you.

On the other hand, if you think prices will level off or even fall when you plan to live in the property, then buying may not be such a good idea.

Should I max out 401k or save for House?

Should I max out my 401k or save for a house? That’s a great question, and there’s no correct answer.

You have to consider many factors only relevant to you and your situation. But if you’re looking for some solid advice, here are the main points to consider:

How long do you plan on working? The longer you work, the more likely it is that 401k contributions will pay off for you. If you plan to leave the workforce in 5 years or less, your best bet might be to start saving for your house now.

If you plan on staying employed for another 20 years, then funding your 401k makes more sense.

How much can you contribute? The maximum amount allowed in 2019 is $19,000 (up from $18,500).

If you can put that much away this year, it makes sense. If not, you should consider how much you can realistically save towards a house per year. You might be able to contribute substantially more than $19K per year.

What kind of interest rate do you get on your 401k? A 401k is an investment account with an associated interest rate that fluctuates depending on the market.

At what age should you pay off your mortgage?

The idea of paying off your mortgage as soon as possible is common.

The logic is that you’ll have more money freed up to invest in other things if you’re not making monthly payments on a large loan.

However, by the time you reach retirement age, you’ll be able to borrow from your 401(k) if you need the money for an emergency, so the benefit of paying off your mortgage early may not be worth giving up the money you could’ve been investing all those years.

The actual decision is whether or not to pay off your house during your working life.

You should only do so if you’re comfortable with having no home purchase protection and possibly missing out on other investments that could help boost your retirement savings.

Is it wise to pay off your house?

You’ve probably heard the advice to pay off your mortgage early, but is it r a good idea? Paying off your home loan can seem like a pretty sweet deal.

It means you’re free from the monthly payments, which is a big load off your mind in itself. You also have the satisfaction of knowing you’ve got nothing to pay.

If it were that simple, though, you’d probably be hearing from people who had been paying their mortgages for years and years with no end in sight.

For one thing, it’s not possible to do. Suppose you’re in an area where house prices are skyrocketing. It’s a great idea to liquidate your equity into cash and invest elsewhere, where it will grow faster than any interest you could earn on a mortgage.

And if your job requires a lot of travel or you can’t commit to living in one place for at least seven years, then it may not be feasible either.

But even if those issues aren’t in play, there are still some questions you might want to ask yourself before diving right into paying off your house.

Summary

A solo 401(k) is a great way to save for retirement if you run your own business. You can contribute up to $55,000 each to the plan as an employer. In addition, employees can contribute up to $18,500 a year if they’re under 50 or $24,500 if they’re 50 or over.

And unlike other retirement plans that limit which investments you can use (like IRAs), there are no restrictions on the investment options available in a solo 401(k).

You’ll also want to think about how much money you need when it comes time for retirement—and whether or not you should invest some of it now so there will be more income.

Research has shown that people who start saving early tend to have more giant nest eggs than those who do not (even when controlling for age).

The earlier one starts saving for retirement and investing their money wisely, the longer their savings will have time to grow and compound—and therefore, more cash at the end of their lives.

Solo 401(k) has many benefits but can also be complicated to set up and manage. If you’re considering investing in one, ensure your financial advisor is a certified solo 401(k) specialist or has extensive experience with these plans.

An excellent place to start is by looking for an advisor who has worked with clients like yourself—someone who knows what’s essential when planning for retirement and how best to meet those goals.