Last updated Apr. 26, 2023 by Peter Jakes

Budgeting can be easily mistaken for an easy task. It’s just setting a part of your income aside, right? Well, it’s easier said than done, especially when irregular expenses keep popping up.

Budgeting for irregular expenses can be complicated and frustrating. You might stick to your monthly budget but end up sitting with a calculator, wondering where it went wrong right before the month ends.

Well, the process of budgeting for irregular expenses mostly ends in disaster. And sometimes, it makes one quit and pack up budgeting plans altogether.

However, before you wave the white flag to surrender, I’ll give you ten ways to avoid disaster while budgeting for your irregular expenses. Let’s take a look at what they mean first.

Irregular Expenses; What Do They Mean?

Budgeting for an irregular expense is almost impossible without fully understanding it. However, they are irregular and infrequent but easy-to-predict bills paid quarterly, yearly, or any time without a place in a traditional monthly budget, unlike groceries and rent.

Although they are easy to predict, they are easily forgotten until they are due, thus disrupting our budgeting.

Budgeting Expenses; Examples

There are several types of expenses that individuals need to plan for to avoid financial surprises. Examples of these irregular expenses include;

#1. Insurance Expenses

Insurance provides financial protection against unforeseen events. Therefore, it is important to consider the needed insurance coverage type and build the cost into the budget.

Also, it’s essential to consider the billing frequency, whether monthly or annual. Some common types of insurance to consider include auto insurance, which covers vehicle damages and liability in the event of an accident.

Others include life insurance, which provides financial protection for loved ones in the event of the policyholder’s death, and disability insurance, which provides financial support if the policyholder cannot work. Also, there’s health and dental insurance, including medical and dental expenses coverage.

#2. Home/family Expenses

Owning a home comes with various expenses, including maintenance, repairs, and replacement of appliances and furniture. However, these expenses sometimes are surprising.

So, to manage these expenses effectively, it’s important to allocate a portion of the budget toward home upkeep. Home maintenance includes regular tasks such as cleaning gutters, changing air filters, checking the HVAC system, leaking roof fixes, repairing plumbing issues, or replacing damaged flooring.

Refrigerators, washing machines, and dishwashers have a lifespan and will eventually need to be replaced. Likewise, furniture must be replaced or added over time as individual preferences or needs change. Planning for these expenses lets you maintain your home’s value and avoid unexpected financial burdens.

#3. Taxes, Retirement, and Charity

Contributions towards taxes, retirement savings, and charitable causes are necessary expenses that need to be planned for. It’s crucial to estimate these expenses to avoid any financial surprises.

Some common contributions to consider include estimated tax payments, which must be made throughout the year to avoid penalties for underpayment of taxes. There are also property taxes, which the government assesses based on the property’s value, and income tax payments.

Additionally, retirement planning is essential for a secure financial future. Contributions towards retirement funds, such as 401(k)s and individual retirement accounts (IRAs), can provide financial stability in retirement.

Lastly, charitable donations are important to many individuals’ financial plans. Planning for these contributions can help individuals support causes they care about while staying within budget.

#4. Pet Expenses

Owning a pet can bring joy and companionship, but it also comes with expenses that can add up quickly. Pet expenses may include pet check-ups, vaccinations, prescriptions, pet grooming, pet licensing, and pet boarding.

Additionally, pet health insurance can be a wise investment to help offset unexpected veterinary bills. Planning for these expenses ensures your pets receive proper care without sacrificing financial stability.

#5. Education Expenses

Pursuing education can be pretty costly for oneself, children, or anybody. And they could also come up unexpectedly. So to avoid any financial burden, planning for education expenses in advance is important.

Some common education expenses to consider include tuition bills, class dues, technology fees, school and office supplies, and school pictures and yearbooks. By planning for these expenses, individuals can ensure they or their children have the necessary resources to succeed academically without compromising their budget.

#6. Health Expenses

While having health insurance can provide significant financial protection, unexpected medical expenses can still arise and jeopardize your savings budget. To avoid any financial surprises, you must plan for health-related expenses.

Some common expenses include yearly check-ups, medical and vision, glasses or contacts, medical bills, dental cleanings and work, and insurance deductibles. By budgeting for these expenses, individuals can avoid the stress of unexpected medical bills and stay on top of their health.

#7. Personal Care Expenses

These costs trigger impulse decisions because they deal with what we wear and how we look. However, it is advisable to plan for these expenses in advance. Examples of these personal care expenses include; hair and nail care, clothing & accessories, and cosmetics.

#8. Leisure Expenses

Including leisure activities in one’s budget is important to maintain a healthy work-life balance. However, planning for these expenses is essential to avoid overspending.

Leisure expenses may include vacations and travel, magazine and newspaper subscriptions, TV and movie streaming subscriptions, like Netflix or Amazon Prime, season tickets and pass, and fine dining events.

By planning for these expenses in advance, individuals can enjoy leisure activities without compromising their financial stability.

So let’s see how you can take the bull by the horn and avoid these expenses.

What are the Best Ways to Reduce or Avoid Irregular Expenses?

Budgeting for irregular but predictable expenses means knowing what you spend & how much you spend on this expense, which is a good way to reduce these expenses. However, disasters are quick to happen when budgeting for an irregular expense.

Here are the top ten ways to avoid disaster budgeting irregular expenses.

#1. Curate an Extensive List of Your Irregular Expenses

A secure way to reduce expenses is to have an extensive list of your irregular expense to keep track of your cost. And ensure that every expense is remembered while budgeting for your monthly bills.

Regardless of how trivial you think these expenses are, it is essential to calculate these irregular expenses in a detailed format. In addition, ensure to cross-check the list daily for slip-throughs.

Also, include expenses that may not have been included initially. Again, this creates order in your budgeting system. You can check here to see how to do this if you’re new to it.

#2. Reinforce your Emergency Fund

Emergency funds are cash reserves stored in a separate savings account to ease the burden of an unanticipated monetary crisis. Ideally, having an emergency fund means you have enough money to cushion yourself in the event of a financial mishap.

That’s because you should be able to afford 3-6 months’ living expenses. However, the existence of this emergency fund doesn’t make your irregular expenses disappear.

But it can help save your budget, protect your assets, and avoid unnecessary financial struggles.

#3. Pay Off Your Debt

Another significant way to lessen your expenses is to eliminate your debt. Monthly payments for your outstanding loans or credit card balance creates a lesser financial margin.

This results in having more complex accountability for your irregular expense, which may lead to disaster budgeting. For example, say you make a monthly payment of $700 for your consumer debt, which totals $8400 of your annual savings that are being sacrificed.

You can use that amount o find your irregular savings account or boost your investments or savings. Settling your consumer debt releases you from the financial obligations associated with it. It creates more room in your budget & improves financial stability as well.

#4. Prioritize Your Spending For More Budgeting

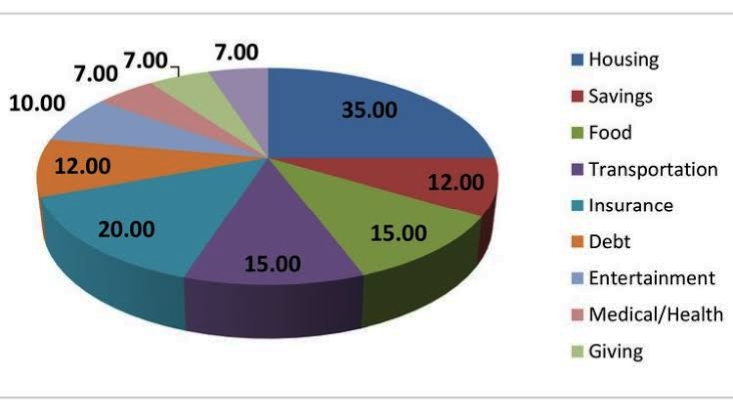

Another way to reduce the strain of budgeting for irregular expenses is to adjust your spending to free up more budgeting cash. The first step in making these adjustments is to carefully overview each category.

What you do here is see where to easily pull money from without causing any drastic change to your financial performance/margin. Simply put, you should create a list of priorities in order of importance for all categories.

For example, when one has to make budgeting adjustments to pay for an irregular expense, the least essential category is shortened and used to cover the expense.

However, If the category doesn’t cover the expense, the next step would be to move in increasing order of the list. This ensures that you don’t dip into other budget categories.

#5. Update your Budget Frequently

One of the best ways to reduce your expense & keep your budget in check is by revising your budget daily. This might sound quite tasking, but it creates a much easier budgeting process.

When your budget is updated daily, it gives a refreshed overview of your financial situation. And spending 2 to 3 minutes updating your budget helps create a habit of this activity.

In addition, it helps you stay on track throughout the month and lets you know how much money each budget category has left to spend before the limit is reached. You can make adjustments to specific areas where you might be overspending.

#6. Utilize the “One Account” Rule

The ‘debit card-only rule is an effective way to keep you on your toes with your spending expenses. Why is this system effective? That’s because the money comes from one’s checking account whenever money is spent.

With that, you can track spending from your account to lessen the budgeting burden and simplify the process. In addition, it provides absolute financial clarity & accuracy.

Though this might be pretty intense for some people, it reduces the chances of irregular expenses going unnoticed, limits one’s spending, and increases saving.

#7. Include A Miscellaneous Category in Your Budget

Having a miscellaneous category in your budget handles any non-recurring expense that may come up unexpectedly. But, of course, you always encounter these non-recurring expenses, no matter how consistent your spending is.

It might be a home appliance repair, a health insurance bill, or that field trip your child desperately wants to go for. The category creates a safety net for you to fall on when these expenses arrive. That’s so you won’t need to take from other budget categories to offset these expenses.

What to consider when budgeting this miscellaneous expense?

The first thing when setting a percentage for this category is the consistency of your monthly expenses and the accuracy of your budget. Afterward, allocating 1-5% of your monthly budget to the category would be best.

For example, if you have your budgeting on lockdown alongside consistent monthly spending, you can allocate 1% of your monthly income to this miscellaneous budget.

However, if you are still new to the budgeting plan and trying to balance your spending, allocate about 5% of your monthly income to the miscellaneous category. Regardless, you should think carefully about your options and make the best financial decision.

#8. Simplify your financial life with Automatic payments

Simplify your financial struggles with irregular expenses by setting up an Automated payment process for your bills. I recommend setting up automated payment processes for monthly bills (i.e., Fixed, monthly expenses). Irregular expenses do not have a fixed payment interval; hence should be paid manually.

The automated payment process eliminates financial expense surprises and simplifies budgeting for irregular expenses.

#9. Budgeting with your spouse

Budgeting plans for married couples comes with its challenge. However, it proves effective when you and your spouse are on the same page regarding budgeting. By forming a team with your partner when budgeting, it becomes easier to plan every monthly budget.

You must make budgeting decisions and work toward the financial goal equally set. You and your partner can hold meetings where you discuss ideas to improve your financial situation, set up regular budget check-ins, and create weekly assessments to monitor progress.

Also, setting financial priorities can help provide accountability and clarity.

#10. Pay Yourself First

Spending before saving is an impulsive decision many individuals sometimes take. Unfortunately, this mistake puts achieving our financial goals at risk. So, savings should be your priority to meet your monthly savings goal and achieve budgeting success.

Simply put, a habit of saving and investing should be created before commencing payment of bills and expenses. So how does This Tip help? Well, extra money is being allocated into your miscellaneous category, preventing any irregular expense surprises.

However, you can transfer the money into your savings account if no irregular expense occurs during that month. That’s one of the best ways to ensure you budget effectively for irregular expenses.

How Can You Budget For Irregular Expenses?

Budgeting for irregular expenses is usually tasking, but here is a list of five tips that could help answer the question of ‘How to budget for an irregular expense.’

- Identify and list out your irregular expense.

- Set a rough estimate for each expenditure.

- Categorize these irregular expenses.

- Create an annual required capital for each category.

- Create and set aside periodic expense savings accounts and fund them monthly.

#1. Identify and list Your Irregular Expenses

The first step in budgeting irregular expenses is to list these expenses electronically or on good old-fashioned paper. Then, you can check previous bank statements or credit card balances to find the unbudgeted expenses.

That could include oil changes on your vehicle, 90-day prescription supplies, or quarterly tax estimates. Essentially, this list should include any expenses the following year.

#2. Set a rough dollar estimate for each category

The next step is to allocate a fee to each irregular expense listed. Of course, the cost may vary for the items on the list. Nevertheless, estimate how much you would spend on each expense.

#3. Categorize these Irregular Expenses

These groups should consist of a variety of similar irregular expenses. Some examples include education-(School supplies, Tuition bills), health-(medical bills, Glasses, check-ups), and recreation expenses-(fine dining events, season tickets, magazine subscriptions).

#4. Create an Annual Dollar Amount for the Total of Each Category

This part can be tricky, but these two steps can help simplify the process. First, create an Annual dollar amount from the total of each category.

Here’s an example; if you spend $100 quarterly on tuition fees, alongside paying $50 semi-annually for school supplies, you will need to add $700 to your education fund as an annual payment to cover the expense.

#5. Add up the total amount from all categories to get the full amount

This is done to get the total annual dollar amount for your list of irregular expenses, then divide this amount by 12. With this, you’ll get the amount to incorporate into your monthly budget.

Here’s a Tip; A better strategy would be to divide the total amount by ten. Why? Because the divide-by-ten strategy helps solve situations by building a buffer fairly quickly that prevents a mishap in your budgeting.

#6. Create an Irregular Expense Saving Account

Creating a separate high-interest saving account for monthly funding with the estimate of your irregular expense helps you stay organized & builds better accountability towards budgeting. Also, it helps you to avoid surprises when the bills arrive.

As your irregular expenses arrive, you can pay them from the savings account to lighten the burden of irregular expenses. Note that setting up an automated payment process for saving your irregular expense is guaranteed to lighten more load.

This process automatically pays a small amount of money into your separate savings account monthly or from every paycheck, making it hard to miss the payment.

Final Note

Budgeting for irregular expenses is one of the most common financial difficulties faced while budgeting. However, with these tips, budgeting for irregular expenses does not have to be complicated or overwhelming. Instead, they are guaranteed to reduce the workload of irregular expenses and keep your budget in line.

Some Frequently Asked Questions On Avoiding Irregular Expenses

What are the four types of expenses?

- Variable expenses: These are expenses that vary monthly (Electricity, groceries)

- Fixed expenses: These remain fixed monthly(for example, rent and vehicle payments).

- Irregular expenses: These are non-recurring expenses (examples: water bills, Tuition payments).

- Discretionary expenses: These are desirable expenses(examples; personal gifts, entertainment )

How do you manage your daily expenses?

Here are five ways to help you take charge of your daily expense.

- Record your daily expense.

- Assess your weekly spending.

- Separate your expenses from other costs.

- Stay consistent with your expense categories.

- Keep a record of your spending receipts.

What are the six steps to planning a budget?

These are six steps to take when planning a budget

- Determine your expense.

- Set goals by determining an amount for savings.

- Choose a budget format and lay a plan.

- Pay yourself first.

- Start your plan.

- Track your progress.

How can students reduce their expenses?

An effective way for students to reduce their expenses is by eliminating unnecessary routine purchases.

What are ten examples of expenses?

Rent, groceries, insurance rates, vehicle maintenance, electricity bill, water bill, house maintenance bill, birthday gifts, medical bills, and personal care.

What is the 50/30/20 budgeting rule?

The 50/30/20 budget rule is a popular budgeting strategy that divides your income into three categories: 50% for needs, 30% for wants, and 20% for savings. This approach helps individuals prioritize their spending and ensure they save for the future.

To determine if this budgeting rule is suitable for your financial situation, it’s important to learn more about it and evaluate how it aligns with your goals.

How do you budget for expenses that aren’t monthly?

If you budget for expenses that aren’t monthly, you must account for them in your budget planning. The process involves listing out all the irregular expenses you anticipate for the year and calculating their total cost.

Divide this total by 12 to determine how much you need to set aside each month to cover these expenses when they occur.

What are the four types of expenses to budget for?

Expenses can be categorized into four distinct groups: fixed, recurring, non-recurring, and whammies. Fixed expenses are regular expenses that remain the same monthly, such as rent or mortgage payments.

Recurring expenses are costs that are paid regularly but may vary in amount, such as utility bills. Non-recurring expenses are infrequent costs, such as car repairs or medical bills.

Whammies are unexpected and often significant expenses, such as emergency home repairs.

What is an irregular cost in accounting?

In accounting, irregular costs are referred to as abnormal costs. These expenses are uncommon and sporadic, often caused by unexpected events such as equipment breakdowns or natural disasters.

Abnormal costs can significantly impact a company’s finances and must be accounted for in budget planning.

What are five ways to balance your budget?

Balancing your budget is essential for maintaining financial stability. So to achieve this, you should create a balanced budget, keep track of your income and expenses, stay on top of your monthly bills, prepare for unexpected expenses, and avoid overspending.

By setting financial goals and determining how much to save each month, you can work towards achieving their objectives while maintaining a balanced budget.

What are the four methods for managing and controlling a budget?

There are four budgeting methods that companies typically employ to manage and control their expenses: incremental budgeting, activity-based budgeting, value proposition budgeting, and zero-based budgeting.

You must understand that each of these methods has its benefits and drawbacks.

What is the most effective approach for preparing for unexpected expenses in your budget?

To be prepared for unexpected expenses in your budget, taking proactive steps and anticipating potential challenges is important. One approach is to find ways to stretch your budget, such as requesting payment plans for certain expenses.

Additionally, you can consider new borrowing options or be cautious about liquidating investments. It’s also wise to have emergency savings set aside to cover any unforeseen expenses that may arise.

How can you effectively manage and track your budget and expenses?

To manage and track your budget and expenses effectively:

- Start by creating a monthly spending plan that includes your anticipated income and expenses.

- Record your spending throughout the month, and at the end of the month, compare your actual spending to your budget plan.

- Use this information to adjust your budget for the following month as necessary.

What are examples of irregular expenses you should budget for?

Irregular expenses occur sporadically throughout the year, such as car repairs, medical, or home maintenance. To ensure you’re prepared for these expenses, it’s important to budget for them in advance by setting aside money each month.

By doing so, you can avoid the stress and financial strain of using credit cards or taking out loans to cover these expenses.

How can you budget effectively with an irregular income?

Budgeting with an irregular income can be challenging, but there are steps you can take to manage your finances effectively. Start by listing your income and expenses, and plan conservatively based on the lower end of your income range.

Subtract your expenses from your income, and track your monthly spending. Then, make adjustments as necessary on payday, and create a new budget before the start of each month based on your income for the previous month.

What are the three budget rules?

There are various budgeting rules that people follow to manage their finances effectively. One model suggests dividing your income into three categories: 50% for essential expenses, 15% for retirement savings, and 5% for emergency funds. This approach helps you care for your immediate needs and plan for the future before spending on anything else.

What is the 70/20/10 rule budget?

Another budgeting rule is the 70/20/10 rule, where you allocate 70% of your income towards living expenses, which can be further divided into fixed and variable costs.

You save 20% of your salary for building your savings or paying off debts, and you spend the remaining 10% on investing your money or donating it.

What is the 100 rule of money?

The 100 Rule is a guideline used by financial professionals to help individuals allocate their retirement and investment assets properly. This rule considers your age and investment horizon to determine your risk tolerance, enabling you to make informed decisions about investing your money.